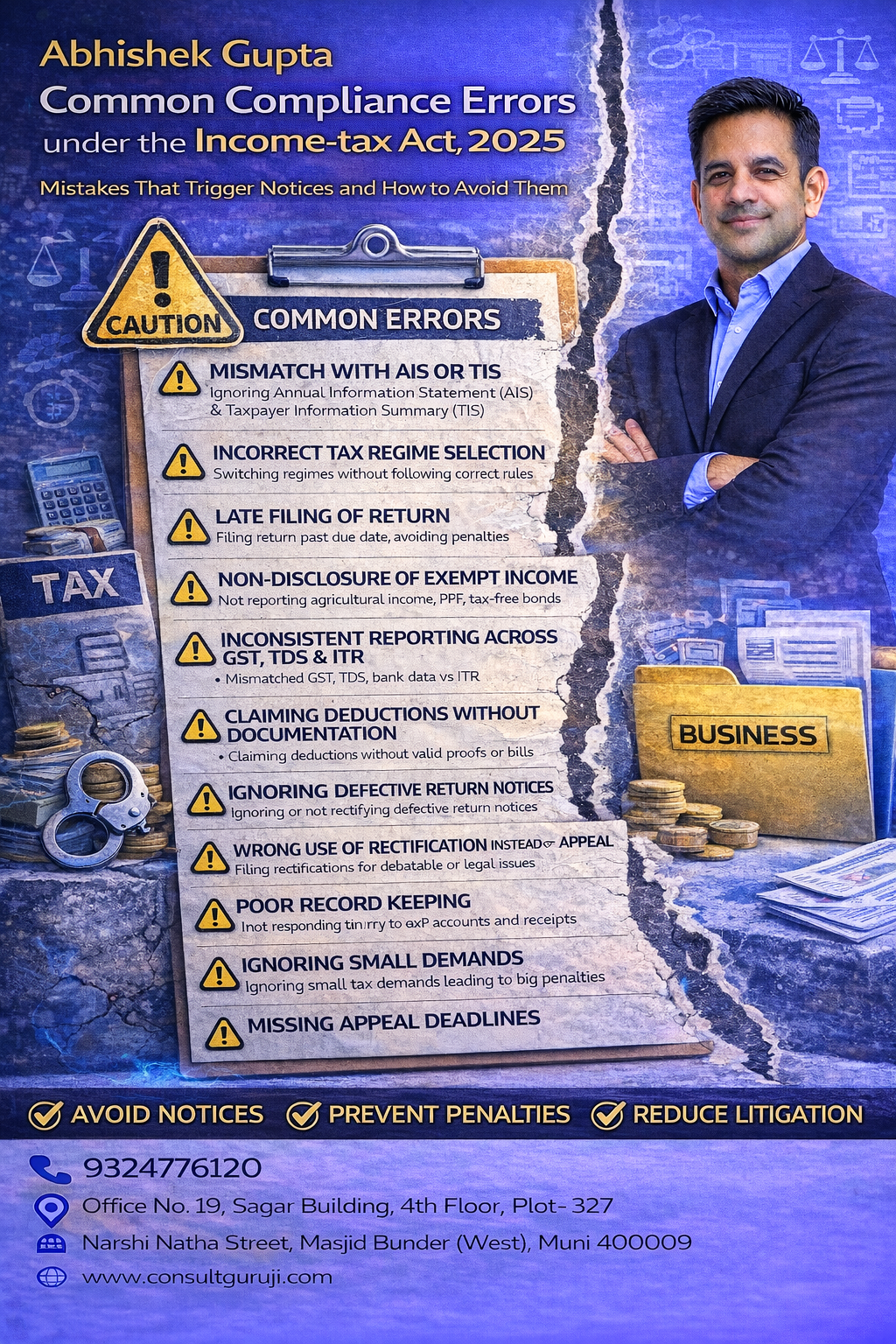

Common Compliance Errors under Income-tax Act, 2025

The Income-tax Act, 2025 has transformed tax compliance into a data-driven, system-monitored process. While the law itself is not harsher, tolerance for errors has reduced significantly.

Most tax disputes today arise not from tax evasion, but from avoidable compliance mistakes. Understanding these common errors is the first step towards staying notice-free.

1. Mismatch with AIS and TIS

One of the most frequent errors is filing the return without reconciling:

AIS (Annual Information Statement)

TIS (Taxpayer Information Summary)

Income reflected in AIS but not reported in the return almost automatically triggers scrutiny or adjustment.

Ignoring AIS is treated as acceptance of data.

2. Incorrect Tax Regime Selection

Many taxpayers select:

New tax regime but still claim old-regime deductions

Old regime without filing proper option

This results in:

Denial of deductions

Additional tax demand

Rectification or appeal burden

Tax regime selection must align with actual computation.

3. Late Filing of Return

Late filing under the 2025 Act leads to:

Mandatory late fees

Interest on tax payable

Loss of carry forward of losses

Restricted revision rights

Belated filing is no longer a harmless delay.

4. Non-Disclosure of Exempt Income

Taxpayers often assume exempt income need not be reported.

This is incorrect.

Exempt income like:

Agricultural income

PPF interest

Tax-free bonds

Dividend (where exempt)

must still be disclosed. Non-disclosure raises red flags.

5. Inconsistent Reporting Across GST, TDS, and ITR

For businesses, inconsistency between:

GST returns

TDS returns

Income-tax return

Bank statements

is a major compliance failure.

Cross-system mismatch is one of the strongest scrutiny triggers under the new Act.

6. Claiming Deductions Without Documentation

Deductions claimed without:

Proof of payment

Eligibility check

Supporting documents

are routinely disallowed during assessment.

In faceless proceedings, no document means no deduction.

7. Ignoring Defective Return Notices

Defective return notices are often ignored or responded casually.

Failure to rectify defects within time results in:

Return being treated as invalid

Loss of compliance status

Exposure to penalties

A defective return is a warning, not a suggestion.

8. Wrong Use of Rectification Instead of Appeal

Taxpayers frequently file rectification applications for:

Debatable issues

Legal disagreements

Disallowances requiring adjudication

Rectification is meant for apparent mistakes only.

Using it incorrectly leads to rejection and loss of time.

9. Non-Response or Delayed Response to Notices

Under faceless assessment, timelines are strict.

Non-response or delayed response results in:

Ex parte orders

Adverse additions

Increased litigation

Silence is treated as acceptance.

10. Poor Record Keeping

Inadequate maintenance of:

Books of accounts

Invoices

Bank statements

Capital gain workings

Loan records

weakens defence during assessment.

Digital compliance demands documentary discipline.

11. Ignoring Small Demands

Many taxpayers ignore small outstanding demands.

These demands:

Accumulate interest

Block refunds

Escalate into recovery proceedings

No demand is too small to ignore.

12. Missing Appeal Deadlines

Delay in filing appeal:

Makes order final

Eliminates legal remedy

Forces payment even if order is wrong

Limitation under tax law is unforgiving.

Conclusion

Under the Income-tax Act, 2025, most tax problems arise from compliance errors, not tax fraud.

Avoiding these common mistakes:

Reduces scrutiny risk

Protects refunds

Preserves appeal rights

Saves litigation cost

In a system-driven tax regime, accuracy and timeliness are the real tax planning tools.

Smart compliance today prevents painful disputes tomorrow.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com