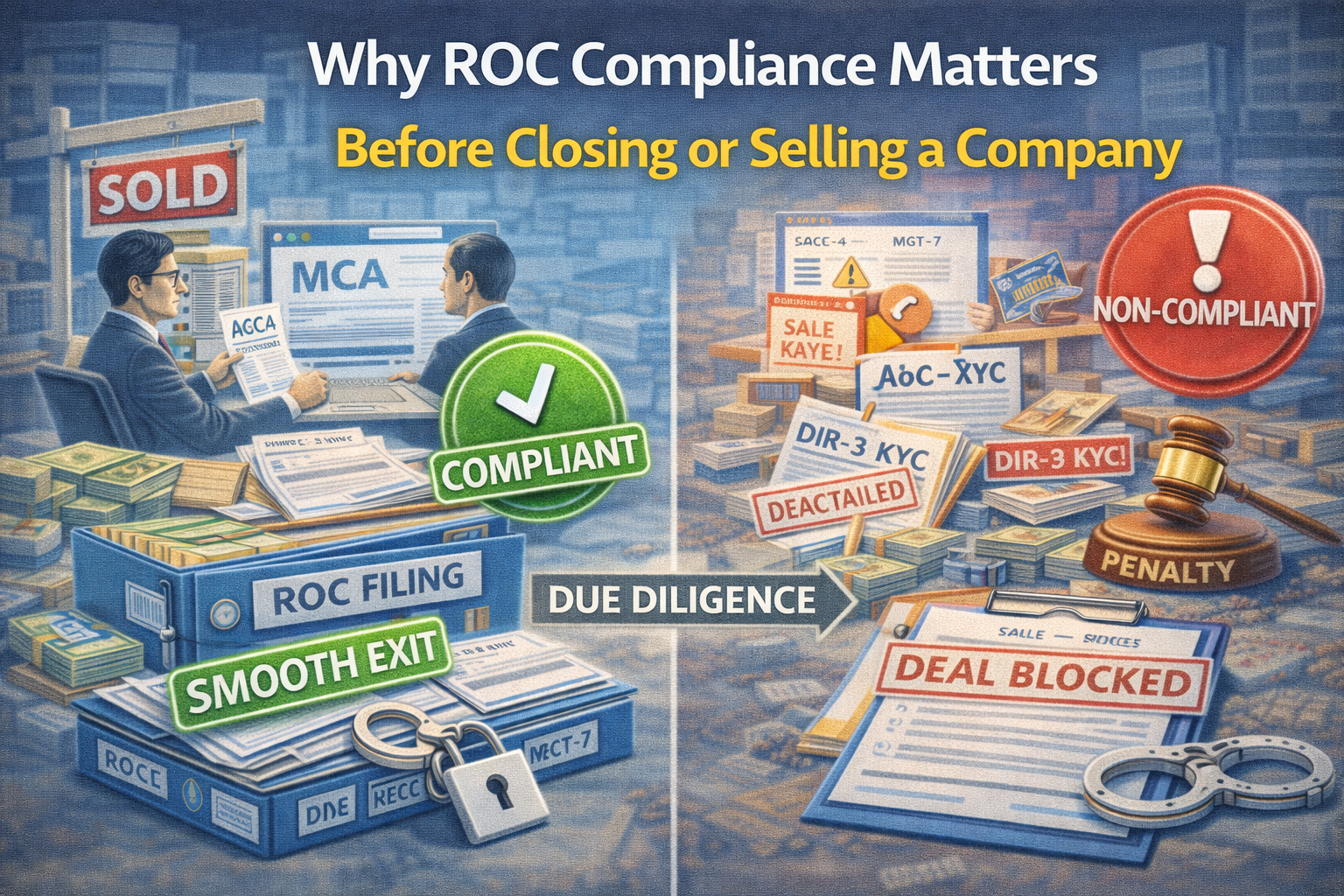

Why ROC compliance matters before closing or selling a company

Many business owners decide to close or sell a company assuming it will be quick and simple.

That assumption breaks the moment due diligence starts.

Whether you plan to close, sell, merge, or transfer ownership, the first thing checked is ROC compliance.

If ROC records are not clean, the exit gets delayed or completely blocked.

This blog explains why ROC compliance is critical before closing or selling a company.

What Is ROC Compliance

ROC compliance means timely filing of all statutory returns and event-based forms with the Registrar of Companies under the Companies Act, 2013.

This includes:

Annual filings (AOC-4, MGT-7 / MGT-7A)

Director compliances (DIR-3 KYC)

Share capital and allotment filings

Registered office updates

Director appointment and resignation filings

ROC records show the legal history of the company.

Why ROC Compliance Is Checked Before Closure or Sale

Before approving:

Strike-off

Voluntary liquidation

Sale of shares

Merger or acquisition

Authorities, buyers, and professionals verify:

Whether the company is compliant

Whether directors are eligible

Whether ownership records are correct

Non-compliance stops the process immediately.

Importance of ROC Compliance Before Closing or Selling

1. Mandatory for Strike-Off and Closure

ROC will not approve:

Voluntary strike-off

Closure applications

if:

Annual filings are pending

Financial statements are not filed

Director KYC is incomplete

Past defaults must be cleared first.

2. Essential for Sale of Company or Shares

Buyers conduct ROC due diligence to check:

Shareholding pattern

Capital structure

Director history

Past penalties and notices

If ROC records are messy:

Buyer backs out

Valuation drops

Deal gets delayed or cancelled

No buyer takes compliance risk.

3. Protects Sellers and Directors from Future Liability

If ROC records are not updated properly:

Old directors may still appear responsible

Notices may continue after sale

Legal liability may follow ex-owners

Clean ROC exit ensures clean legal exit.

4. Required for Due Diligence and Valuation

Professional advisors verify:

Consistency between ROC filings and financials

Proper filing of share transfers and allotments

Non-compliance raises red flags and reduces company value.

5. Prevents Last-Minute Penalties and Stress

Fixing years of ROC non-compliance at exit stage leads to:

Heavy late fees

Urgent filings

Missed timelines

Deal fatigue

Early compliance avoids panic at exit.

Common ROC Issues That Block Closure or Sale

Non-filing of annual returns

Missing AOC-4 or MGT-7

DIR-3 KYC defaults

Unreported share allotments

Incorrect director resignation records

These issues surface only when it’s almost too late.

How to Prepare for a Clean Exit

Review ROC compliance history early

Clear pending filings year-wise

Update director and share records

Match financials with ROC data

Exit planning should start with compliance review.

Conclusion

ROC compliance is not just about running a company.

It is about exiting the company safely and legally.

Companies with clean ROC records:

Close faster

Sell easily

Command better valuation

Protect directors from future risk

Ignoring ROC compliance can trap you in a dead company for years.

Call to Action

If you are planning to close or sell your company, review and correct your ROC compliance first. A clean ROC record is the foundation of a smooth and safe exit.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com