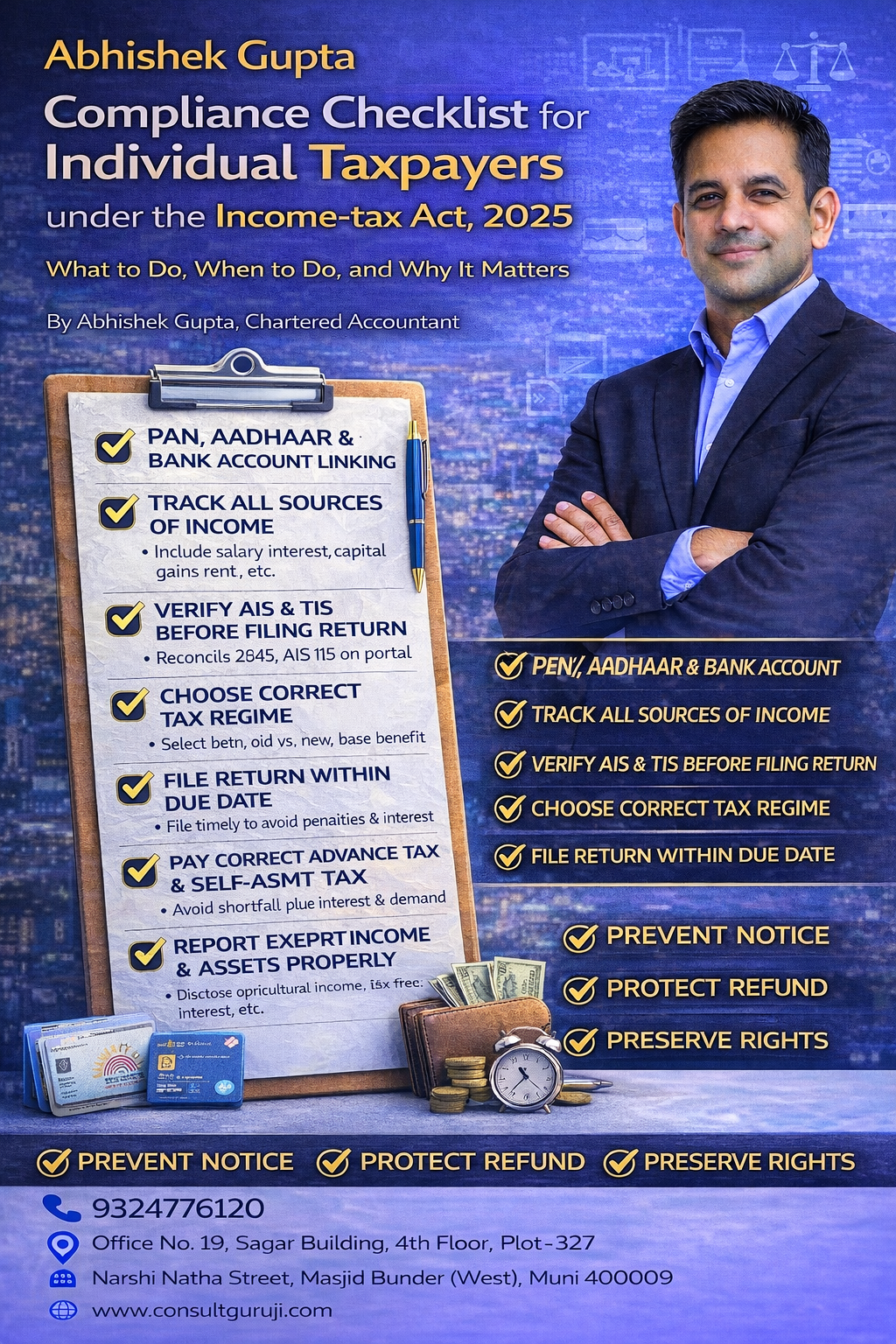

Compliance Checklist for Individual Taxpayers under 2025 Act

The Income-tax Act, 2025 has strengthened compliance expectations for individual taxpayers. With increased digitisation, data matching, and faceless proceedings, casual or delayed compliance now carries higher risk.

This checklist is designed to help individual taxpayers stay compliant, avoid notices, and protect their legal rights.

Think of it as a yearly compliance discipline, not a one-time task.

1. PAN, Aadhaar, and Bank Account Linking

Ensure the following are completed and verified:

PAN is active and valid

PAN is linked with Aadhaar

Bank account is pre-validated on income-tax portal

Any mismatch can result in:

Refund failure

Invalidation of return

Notice generation

2. Track All Sources of Income

Under the 2025 Act, reporting must match digital records.

Include income from:

Salary or pension

Business or profession

Interest (bank, FD, savings)

Capital gains (shares, MF, property, crypto where applicable)

Rental income

Other income (dividend, winnings, etc.)

Unreported income is easily traceable through AIS and TIS.

3. Verify AIS and TIS Before Filing Return

Always reconcile:

Form 26AS

Annual Information Statement (AIS)

Taxpayer Information Summary (TIS)

If incorrect data appears:

Submit feedback on the portal

Maintain supporting documents

Ignoring AIS mismatches is a common trigger for scrutiny.

4. Choose Correct Tax Regime

Evaluate whether:

Old tax regime

New tax regime

is more beneficial.

Once selected:

Apply it consistently

Ensure deductions claimed are legally available under chosen regime

Wrong regime selection can result in demand notices.

5. File Return Within Due Date

Timely filing is critical.

Late filing can lead to:

Late filing fee

Interest on tax payable

Loss of carry forward of losses

Restricted revision options

Belated filing is a concession, not a right.

6. Pay Correct Advance Tax and Self-Assessment Tax

Individuals with income beyond salary must:

Estimate advance tax correctly

Pay self-assessment tax before filing return

Short payment leads to interest and demand.

7. Report Exempt Income and Assets Properly

Even exempt income must be disclosed, such as:

Agricultural income

PPF interest

Tax-free bonds

Also disclose:

Foreign assets or income (if applicable)

Non-disclosure can have serious consequences.

8. Maintain Documents and Records

Keep records for:

Salary slips and Form 16

Bank statements

Investment proofs

Capital gain workings

Rent agreements

Loan statements

Under faceless assessment, documents speak louder than explanations.

9. Respond Promptly to Notices

If a notice is received:

Do not ignore it

Check section and deadline

Respond through portal with clarity and evidence

Non-response leads to adverse orders.

10. Use Revision and Rectification Correctly

If a mistake is found:

Use revised return for genuine errors

Use rectification only for apparent mistakes

Do not confuse rectification with appeal.

11. Monitor Refunds and Demands

After filing:

Track refund status

Check if refund is adjusted against demand

Raise grievance if refund is delayed

Refund is a right, not a favour.

12. Preserve Appeal Rights

If assessment is incorrect:

File appeal within limitation

Seek stay of demand where required

Delay can permanently close remedies.

Conclusion

Under the Income-tax Act, 2025, individual taxpayers are part of a data-driven, system-monitored tax environment.

Compliance is no longer about form-filling.

It is about consistency, accuracy, and timely action.

A disciplined checklist approach:

Prevents notices

Protects refunds

Preserves legal rights

Smart compliance today avoids litigation tomorrow.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com