GST Composition Scheme Explained in Hindi

GST Composition Scheme Explained in Hindi

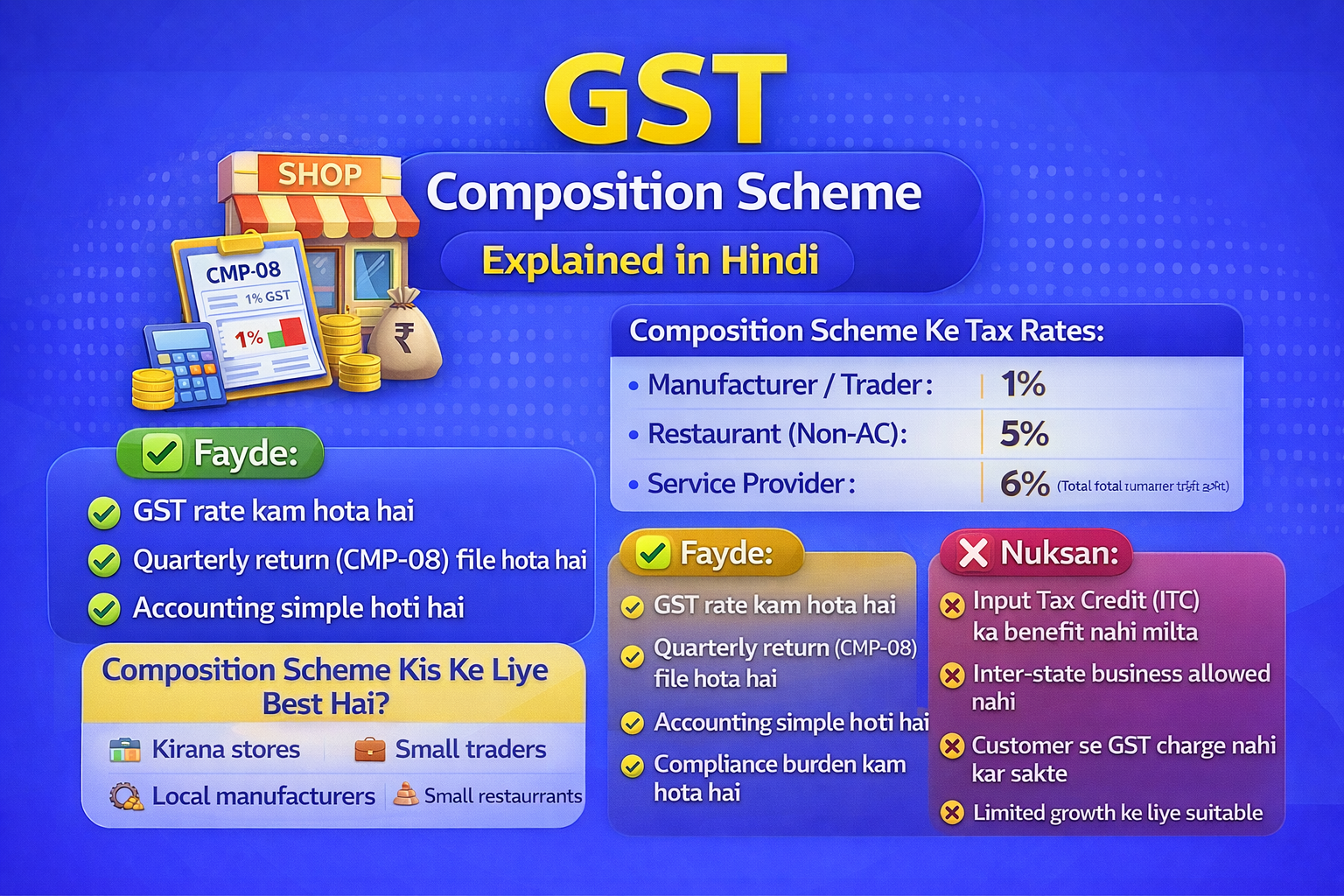

GST Composition Scheme chhote businesses ke liye ek simple tax scheme hai jisme kam tax rate aur kam compliance hoti hai. Agar aap small trader, manufacturer ya restaurant owner hain, to yeh scheme aapke liye kaafi useful ho sakti hai.

GST Composition Scheme Kya Hai?

Composition Scheme ek optional scheme hai jisme eligible taxpayers fixed rate par GST pay karte hain aur unhe regular GST returns file karne ka jhanjhat kam hota hai.

Kaun Composition Scheme Le Sakta Hai?

Annual turnover ₹1.5 crore tak (special states ke liye limit kam hoti hai)

Traders, manufacturers aur restaurant service providers

Inter-state supply nahi karte hon

E-commerce platforms (Amazon, Flipkart) ke through sale nahi karte hon

Composition Scheme Ke Tax Rates:

Manufacturer / Trader: 1%

Restaurant (Non-AC): 5%

Service Provider (Special Scheme): 6%

(Rates total turnover par apply hote hain)

Composition Scheme Ke Fayde:

✔ GST rate kam hota hai

✔ Quarterly return (CMP-08) file hota hai

✔ Accounting simple hoti hai

✔ Compliance burden kam hota hai

Composition Scheme Ke Nuksan:

❌ Input Tax Credit (ITC) ka benefit nahi milta

❌ Inter-state business allowed nahi

❌ Customer se GST charge nahi kar sakte

❌ Limited growth ke liye suitable

Composition Return Filing:

CMP-08: Quarterly tax payment

GSTR-4: Annual return

Composition Scheme Kis Ke Liye Best Hai?

Kirana stores

Small traders

Local manufacturers

Small restaurants

Conclusion:

GST Composition Scheme small businesses ke liye ek achha option hai jo simple tax system chahte hain. Lekin scheme choose karne se pehle apne business model aur future growth ko dhyan mein rakhna bahut zaroori hai.

👉 Sahi decision lene ke liye GST expert ya CA se consult karna hamesha better hota hai.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com