Importance of AOC-4 filing and its impact on directors

Introduction

Many directors think AOC-4 is just another ROC form handled by the accountant.

That assumption is dangerous.

AOC-4 filing directly affects directors’ legal standing, penalties, and even future business eligibility.

This blog explains why AOC-4 is important and how non-filing impacts directors personally.

What Is AOC-4

AOC-4 is the form used to file a company’s financial statements with the Registrar of Companies under the Companies Act, 2013.

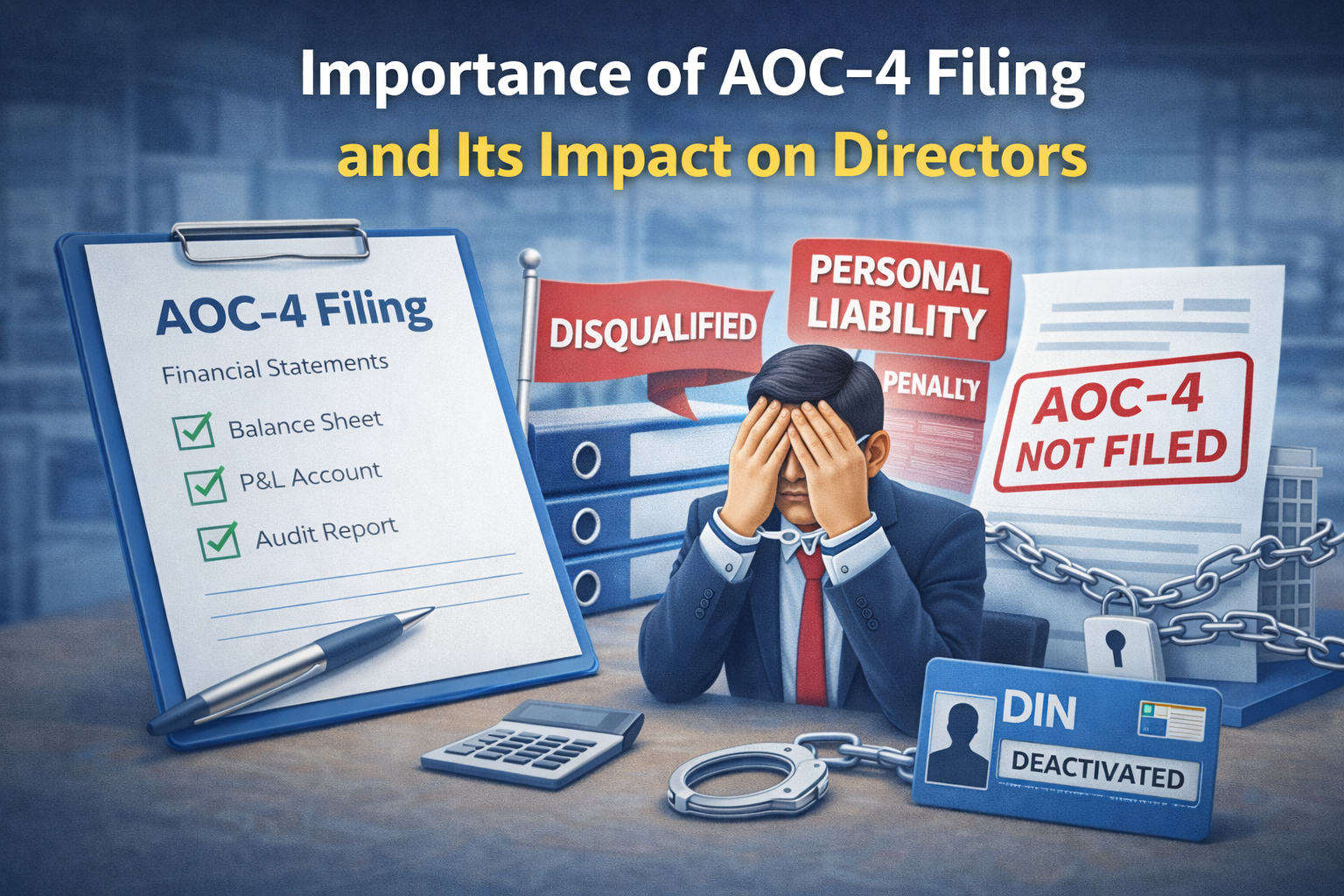

It includes:

Balance Sheet

Profit & Loss Account

Auditor’s Report

Notes to Accounts

This filing confirms the company’s financial position to the government.

Why AOC-4 Filing Is Mandatory

Every company must file AOC-4 within 30 days of the Annual General Meeting (AGM).

Even if:

There is no profit

There is minimal activity

The company is inactive

AOC-4 filing remains compulsory.

What this really means is simple:

No AGM filing = no legal compliance.

Importance of AOC-4 Filing

1. Confirms Financial Transparency

AOC-4 ensures that the company’s financials are:

Audited (where required)

Transparent

Available for government verification

This protects both the company and its directors.

2. Mandatory for Completing Annual ROC Compliance

AOC-4 is the first step of annual ROC compliance.

Without AOC-4:

MGT-7 / MGT-7A becomes incomplete

Annual compliance remains defective

Incomplete compliance creates legal exposure.

3. Essential for Bank Loans and Due Diligence

Banks, investors, and regulators check AOC-4 filings during:

Loan processing

Funding rounds

Company valuation

Missing filings raise immediate red flags.

Impact of Non-Filing of AOC-4 on Directors

1. Heavy Late Fees

Late fees for AOC-4 are charged per day, often without a maximum cap.

Delays of years can lead to:

Huge financial burden

Difficulty in clearing past defaults

2. Director Disqualification Risk

If AOC-4 is not filed for three consecutive years, directors face:

Disqualification under company law

Ban from holding directorships

MCA portal flagging

This impacts all companies where the director is involved.

3. Legal Notices and Prosecution

ROC may issue:

Show cause notices

Penalty orders

Prosecution in serious cases

Directors are personally answerable.

4. Problems in DIN and KYC Compliance

Non-filing leads to:

DIN related restrictions

DIR-3 KYC issues

Difficulty signing future ROC forms

Common Reasons Companies Miss AOC-4

Delay in finalisation of accounts

Assumption of nil activity exemption

Auditor issues

Ignoring AGM timelines

None of these reasons are accepted as legal excuses.

How Directors Can Stay Safe

Ensure AGM is conducted on time

Finalise accounts early

Track AOC-4 due dates personally

Verify filing status on MCA portal

Delegation is fine, responsibility is not transferable.

Conclusion

AOC-4 is not just a compliance form.

It is a director-level legal responsibility.

Timely AOC-4 filing:

Protects directors

Avoids penalties

Keeps the company compliant and credible

Ignoring it creates long-term legal damage.

Call to Action

If your company has missed AOC-4 filing for any year, immediate corrective action is critical to protect directors from penalties and disqualification.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com