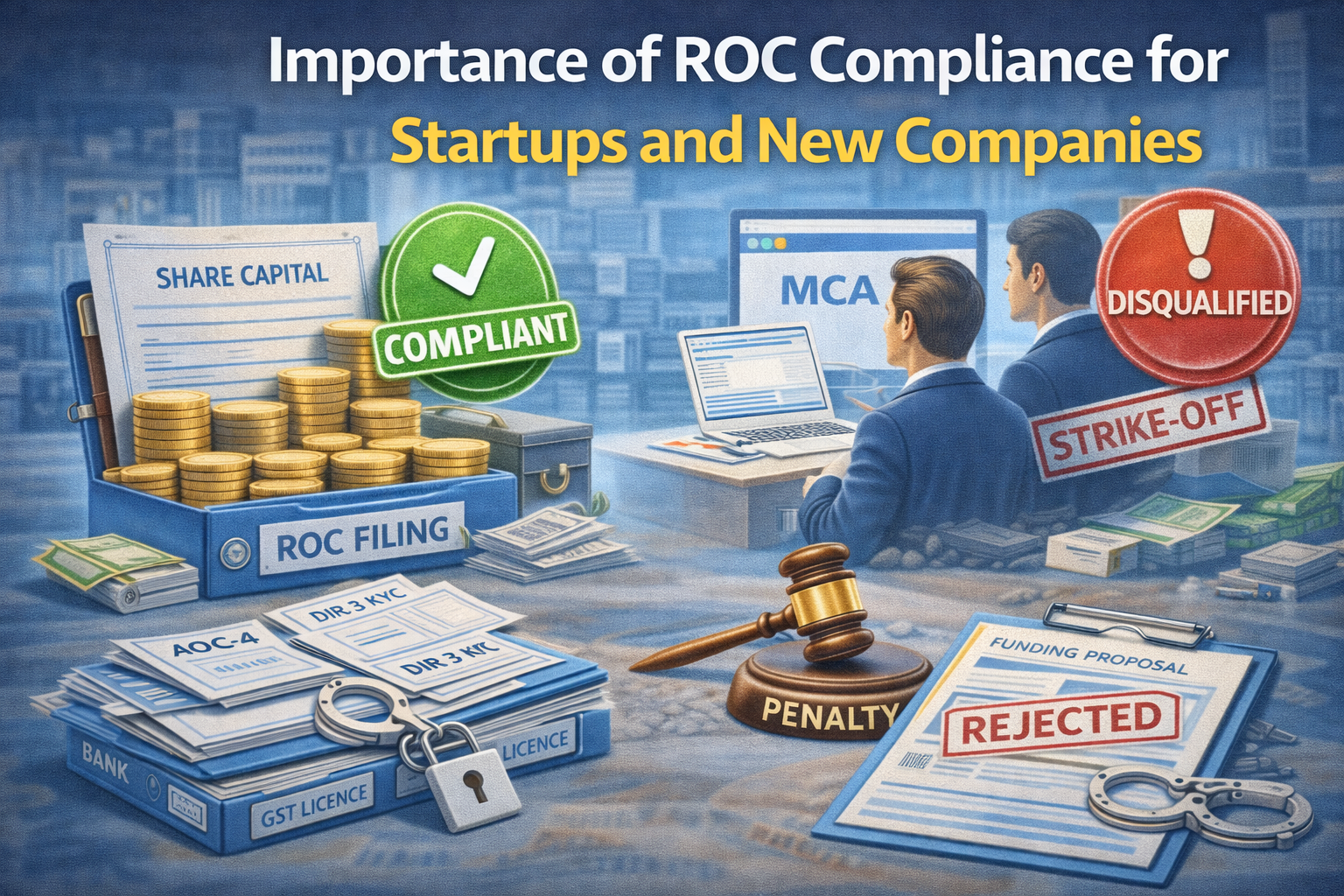

Importance of ROC Compliance for Startups and New Companies

Introduction

Most startups focus on product, funding, and growth. Compliance usually comes last.

That’s a mistake.

ROC compliance is not paperwork for later. It is the legal foundation of a startup.

Ignoring it in the early years leads to penalties, director issues, and problems during funding or exit.

This blog explains why ROC compliance is critical for startups and newly incorporated companies.

What Is ROC Compliance

ROC compliance means filing mandatory returns and event-based forms with the Registrar of Companies under the Companies Act, 2013.

For startups and new companies, this includes:

Annual filings (AOC-4, MGT-7 / MGT-7A)

Director compliances (DIR-3 KYC)

Event-based filings (director changes, address change, share allotment, etc.)

These filings keep the company legally active and trustworthy.

Why Startups Must Take ROC Compliance Seriously

Many startups assume:

No revenue means no compliance

Early-stage companies get relaxations

Compliance can be fixed later

What this really means is risk piling up silently.

ROC compliance applies from day one, regardless of turnover or activity.

Importance of ROC Compliance for Startups

1. Keeps the Company Legally Active

ROC filings ensure the company status remains Active on the MCA portal.

Non-filing can lead to:

Company marked as non-compliant

Strike-off risk

Difficulty operating bank accounts

An inactive status kills credibility instantly.

2. Protects Founders and Directors

Founders are directors. Director-level consequences hit personally.

Non-compliance can lead to:

Director disqualification

DIN deactivation

Inability to start or join other ventures

This is a career-level risk.

3. Mandatory for Fundraising and Investment

Investors and VCs check:

ROC filing history

Shareholding records

Director compliance status

Even one missed filing can:

Delay funding

Reduce valuation

Kill deals during due diligence

Compliance builds investor confidence.

4. Essential for Bank Accounts, GST, and Licences

Banks and authorities cross-verify:

ROC records

Registered office address

Director details

ROC non-compliance causes:

Bank KYC issues

GST complications

Licence and registration delays

Operations suffer directly.

5. Clean Exit, Merger, or Shutdown

Startups often plan:

Acquisition

Merger

Strategic sale

Voluntary strike-off

None of these are possible without clean ROC records.

Fixing years of non-compliance later is expensive and stressful.

Common ROC Mistakes by Startups

Skipping annual filing due to no revenue

Ignoring DIR-3 KYC

Delayed share allotment filings

Not updating registered office address

Assuming CA or consultant will handle everything

Responsibility still lies with founders.

How Startups Can Stay ROC Compliant

Track ROC compliance calendar

File even during zero-revenue years

Complete director compliances personally

Take professional help early, not after notices

Early discipline saves future damage.

Consequences of Ignoring ROC Compliance

Heavy late fees and penalties

Director disqualification risk

Strike-off proceedings

Funding and banking issues

Legal exposure during audits

Most startups realise this too late.

Conclusion

ROC compliance is not a burden for startups.

It is a growth enabler and safety net.

Startups that stay compliant:

Scale smoothly

Raise funds easily

Exit cleanly

Protect founders legally

Ignoring ROC compliance puts the entire startup journey at risk.

Call to Action

If you are a startup or newly incorporated company, ensure your ROC compliance is in order from the beginning. Early compliance prevents costly corrections later.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com