Revised Return vs Updated Return under Income-tax Act, 2025

The Income-tax Act allows taxpayers to correct mistakes in return filing, but not all correction mechanisms are equal. Under the Income-tax Act, 2025, Revised Return and Updated Return serve different legal purposes and carry very different consequences.

Understanding this distinction is critical, especially in an era of data-driven scrutiny.

What Is a Revised Return

A Revised Return allows a taxpayer to correct any error or omission in the originally filed return.

It can be filed when:

The original return was filed within the due date or as a belated return

There is no intent to conceal income

The correction is made within the prescribed time limit

A revised return replaces the original return entirely.

In simple terms, it is a correction without penalty, provided it is done within time.

What Is an Updated Return

An Updated Return is a later-stage disclosure mechanism introduced to encourage voluntary compliance.

It can be filed even after the time limit for revision has expired, but:

Additional tax is mandatory

Certain cases are excluded

It cannot be used to reduce tax liability or claim refund

An updated return is a concession, not a right.

Key Differences Between Revised and Updated Return

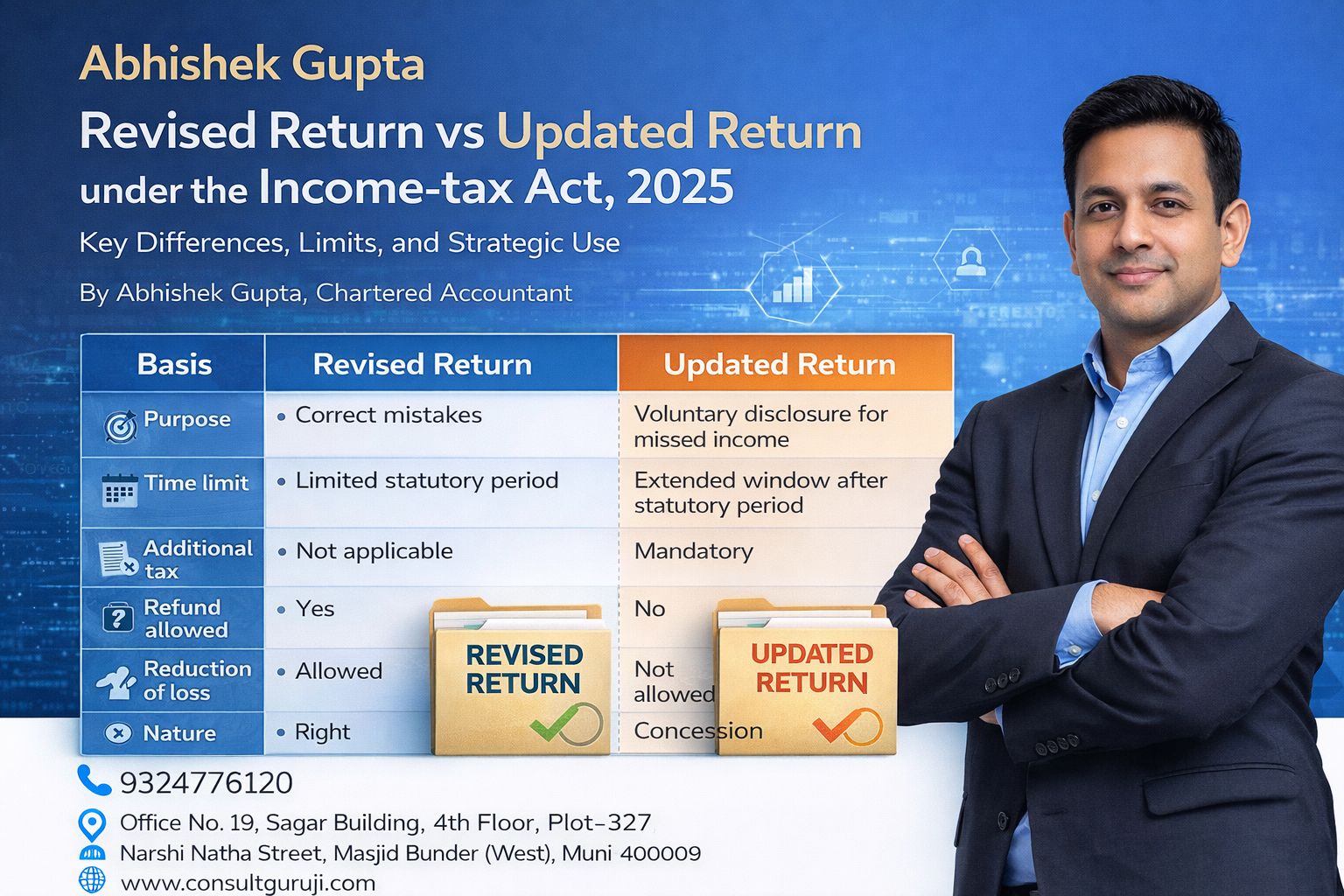

Basis Revised Return Updated Return

Purpose Correct genuine mistakes Voluntary disclosure of missed income

Time limit Limited statutory period Extended window with restrictions

Additional tax Not applicable Mandatory additional tax

Refund allowed Yes No

Reduction of loss Allowed Not allowed

Nature Right Concession

This table alone can prevent costly compliance mistakes.

When Should Each Be Used

Use a Revised Return when:

Error is identified early

No additional tax exposure exists

Losses or deductions need correction

Use an Updated Return when:

Income was genuinely missed

Detection risk is high

You want to close exposure before department action

What this really means is:

Revised return is correction. Updated return is damage control.

Compliance Risks and Practical Caution

Updated returns are closely monitored. Filing one signals that:

Original disclosure was incomplete

Additional tax is being voluntarily paid

While this may prevent harsher action, it also creates a permanent record.

Strategic judgment is essential.

Conclusion

Under the Income-tax Act, 2025, Revised Return and Updated Return are not interchangeable tools.

Choosing the wrong route can:

Increase tax cost

Block refunds

Trigger unnecessary scrutiny

Correct timing and informed choice make all the difference.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com