Role and importance of Registrar of Companies (ROC) in India

Introduction

Every company in India operates under a legal framework.

At the center of this framework is the Registrar of Companies (ROC).

Most business owners hear about ROC only when filing returns or receiving notices. But ROC’s role goes far beyond paperwork. It acts as the guardian of corporate law compliance in India.

This blog explains the role, powers, and importance of the Registrar of Companies and why every company must take ROC seriously.

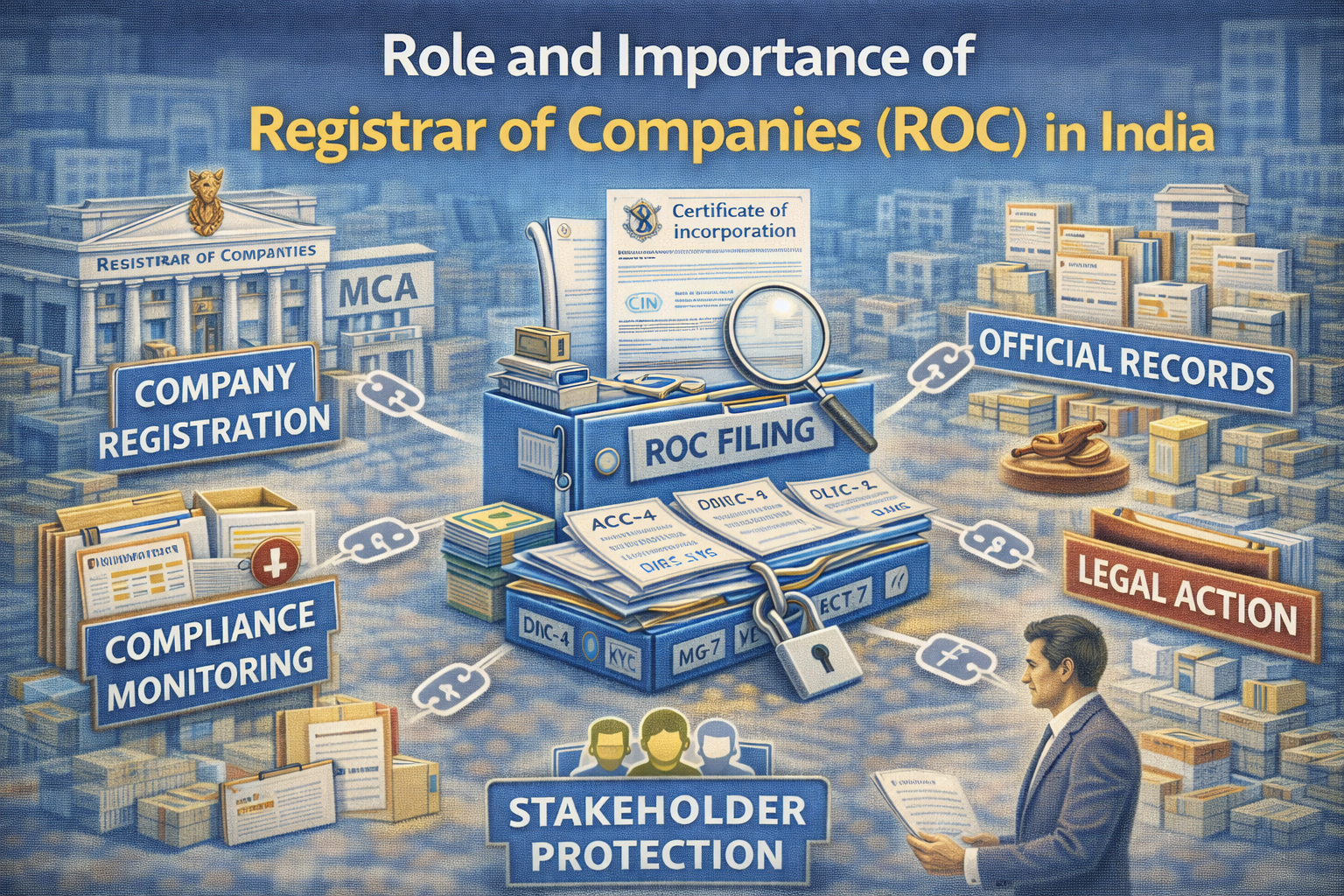

What Is the Registrar of Companies (ROC)

The Registrar of Companies is a statutory authority appointed under the Companies Act, 2013.

ROC functions under the Ministry of Corporate Affairs (MCA) and is responsible for administering company law in India.

Every company registered in India falls under the jurisdiction of a specific ROC based on its registered office state.

Key Role of ROC in India

1. Company Incorporation and Registration

ROC is responsible for:

Registering companies

Issuing Certificate of Incorporation

Allotting CIN (Corporate Identification Number)

Without ROC approval, a company cannot legally exist.

2. Maintaining Official Company Records

ROC maintains the public database of:

Company details

Directors and shareholders

Share capital structure

Registered office address

These records are accessible through the MCA portal and are treated as official government data.

3. Monitoring ROC Compliance

ROC ensures companies comply with:

Annual filings (AOC-4, MGT-7 / MGT-7A)

Director compliances (DIR-3 KYC)

Event-based filings

Non-compliance is tracked electronically and flagged automatically.

4. Issuing Notices and Taking Action

ROC has the power to:

Issue show-cause notices

Impose penalties

Initiate adjudication

Recommend prosecution

ROC action is often the first step before serious legal consequences.

5. Protecting Stakeholders’ Interests

ROC protects:

Shareholders

Creditors

Investors

Public interest

By enforcing transparency and disclosures, ROC ensures companies do not misuse the corporate structure.

Importance of ROC for Companies

1. Legal Recognition and Credibility

A company registered and compliant with ROC:

Is legally recognised

Gains credibility with banks and investors

Can enter contracts and raise funds

ROC status defines whether a company is trustworthy.

2. Foundation for Other Compliances

GST, Income Tax, banks, and regulators rely on:

ROC records

Company status

Director details

Weak ROC compliance triggers issues across multiple departments.

3. Essential for Business Growth and Exit

ROC compliance is mandatory for:

Bank loans and funding

Mergers and acquisitions

Sale or closure of company

Clean ROC records enable smooth growth and exit.

Consequences of Ignoring ROC

If companies ignore ROC requirements:

Heavy additional fees apply

Directors may get disqualified

Company may be struck off

Prosecution may be initiated

Most corporate legal problems begin with ROC non-compliance.

Why ROC Is Important for Directors

ROC records decide:

Who is legally responsible

Who can act as director

Director eligibility and disqualification

Directors are personally impacted by ROC actions.

How Companies Should Deal with ROC

Treat ROC filings as priority, not formality

File returns on time every year

Respond promptly to ROC notices

Regularly review MCA portal records

Proactive compliance prevents future trouble.

Conclusion

The Registrar of Companies is not just a filing authority.

It is the regulator, watchdog, and record-keeper of corporate India.

Understanding the role and importance of ROC helps companies:

Stay compliant

Avoid penalties

Build credibility

Operate safely under law

Respecting ROC is respecting company law itself.

Call to Action

If your company is registered in India, ensure regular and accurate ROC compliance. A strong relationship with ROC through timely filings protects your business and directors in the long run.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com