Small Business Ke Liye GST – Fayde aur Nuksan

Small Business Ke Liye GST – Fayde aur Nuksan

GST (Goods and Services Tax) ne India ke tax system ko simple banane ki koshish ki hai, lekin small business owners ke liye iske kuch fayde hain aur kuch challenges bhi. Is post mein hum GST ke advantages aur disadvantages dono ko simple language mein samjhenge.

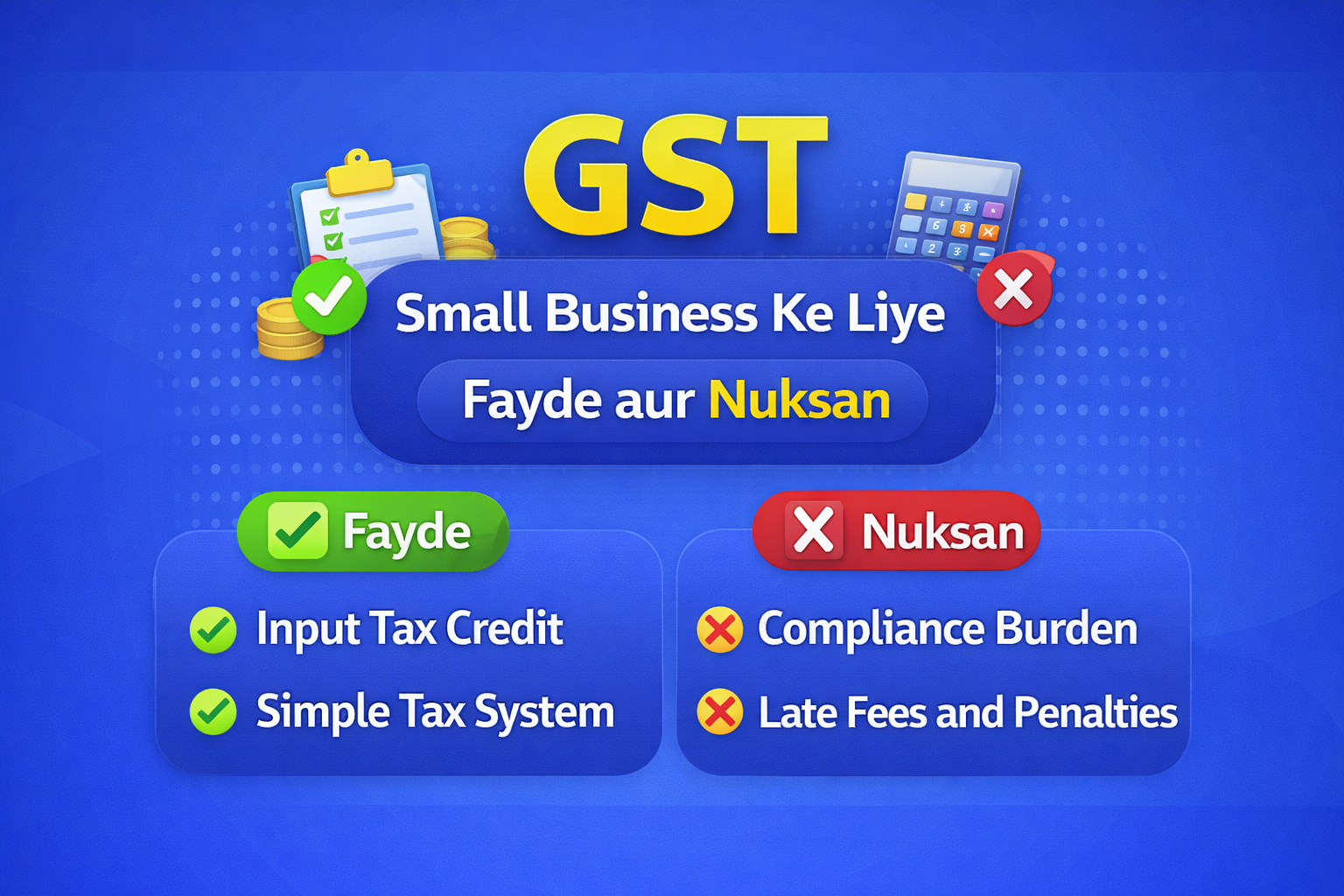

Small Business Ke Liye GST Ke Fayde:

1. Ek Hi Tax System

Pehle VAT, Service Tax, Excise jaise alag-alag tax lagte the. GST ke baad sab ek hi tax mein cover ho gaye, jisse system simple ho gaya.

2. Input Tax Credit (ITC) Ka Fayda

Business apne purchases par diya hua tax, sales ke tax se adjust kar sakta hai, jisse overall tax burden kam hota hai.

3. Business Credibility Badhti Hai

GST registration se business legal aur professional dikhta hai, jisse bade clients aur companies ke sath kaam karna aasan hota hai.

4. Inter-State Business Easy

Ab ek state se dusri state mein business karna simple ho gaya hai, alag-alag state taxes ka jhanjhat nahi.

Small Business Ke Liye GST Ke Nuksan:

1. Compliance Burden Zyada

Monthly / quarterly returns file karna padta hai, jo chhote business ke liye thoda complex ho sakta hai.

2. Professional Cost

CA ya GST consultant ki zarurat padti hai, jisse extra cost badh jaati hai.

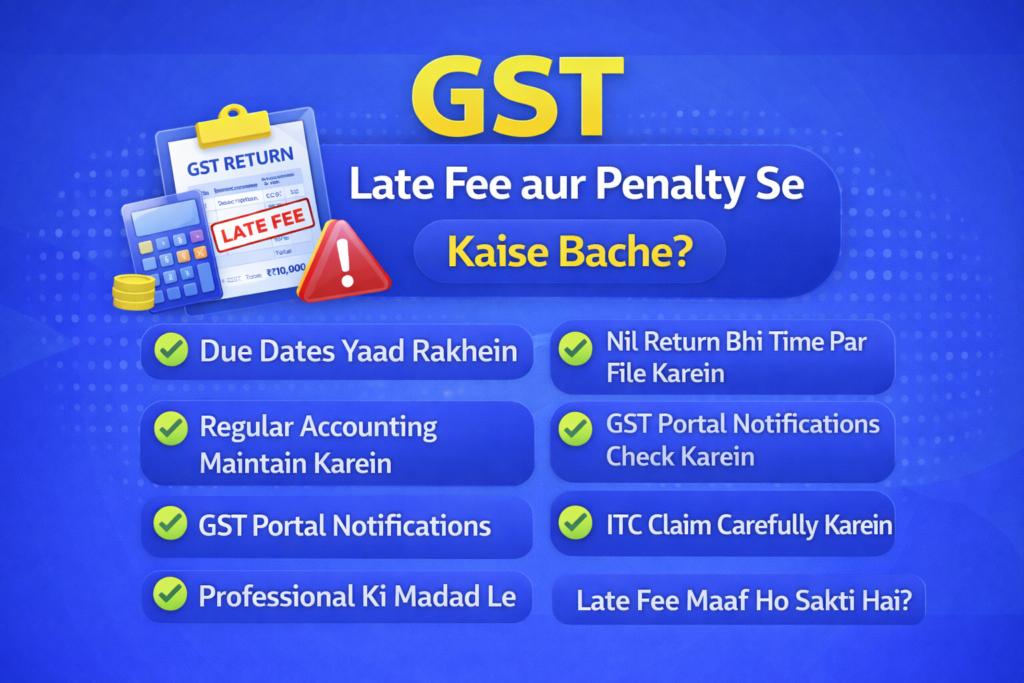

3. Late Fees aur Penalty

Return late hone par penalty aur interest lagta hai, jo small businesses ke liye problem ban sakta hai.

4. Technology Dependence

GST poori tarah online system hai, jisme internet aur technical knowledge ki zarurat hoti hai.

Conclusion:

GST small businesses ke liye long term mein beneficial hai, lekin sahi planning aur timely compliance bahut zaroori hai. Agar process theek se follow kiya jaye, to GST business growth mein madad karta hai.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com