Why DIR-3 KYC is critical for every director

Introduction

Many directors believe DIR-3 KYC is a one-time formality completed at the time of DIN allotment.

That belief is wrong.

DIR-3 KYC is a mandatory annual compliance. Missing it even once can deactivate a director’s DIN and block all company filings.

This blog explains why DIR-3 KYC is critical and how it directly impacts directors.

What Is DIR-3 KYC

DIR-3 KYC is a form filed with the Registrar of Companies to verify a director’s identity and contact details.

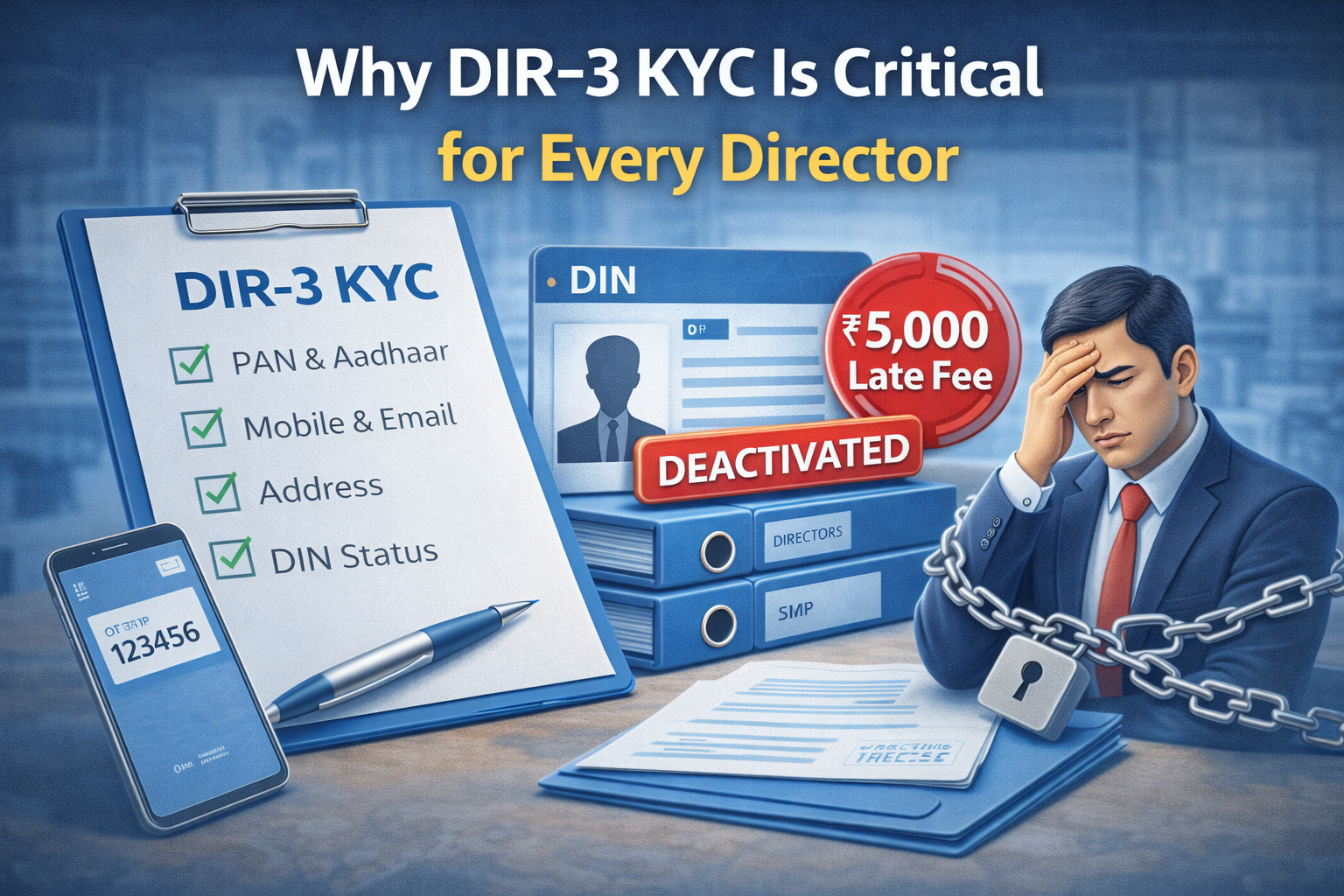

It confirms:

PAN and Aadhaar

Mobile number and email ID (OTP-based verification)

Address and nationality

Status of DIN

This ensures only genuine individuals act as directors.

Why DIR-3 KYC Is Mandatory Every Year

The government requires annual verification to:

Prevent misuse of DIN

Eliminate fake or benami directors

Keep director data updated

Even if:

The director is not active

The company has no business

The director is in only one company

DIR-3 KYC filing is still compulsory.

What this really means is:

DIN remains valid only if KYC is updated every year.

Importance of DIR-3 KYC for Directors

1. Keeps DIN Active

Non-filing of DIR-3 KYC leads to DIN deactivation.

Once deactivated:

Director cannot sign any ROC form

Company filings get blocked

Director role becomes ineffective

2. Prevents Heavy Late Fees

DIR-3 KYC late filing attracts:

₹5,000 late fee per director

This fee is fixed and unavoidable once the due date is missed.

3. Essential for Company ROC Filings

If even one director’s DIN is deactivated:

AOC-4 cannot be filed

MGT-7 cannot be filed

Other ROC forms get rejected

One director’s default can block the entire company.

4. Protects Director’s Future Appointments

DIN deactivation affects:

Appointment in new companies

Existing directorships

MCA compliance history

Future business plans suffer immediately.

Common Reasons Directors Miss DIR-3 KYC

Change in mobile number or email

Assumption that KYC is one-time

Not receiving OTP

Ignoring MCA reminders

None of these reasons are accepted as legal excuses.

How Directors Can Stay Compliant

Update mobile number and email on time

Track DIR-3 KYC due date every year

Verify DIN status on MCA portal

Complete KYC even if company is inactive

DIR-3 KYC is personal responsibility, not company compliance.

Consequences of Ignoring DIR-3 KYC

DIN deactivated

ROC filings blocked

₹5,000 late fee

Loss of directorship eligibility

Legal and professional embarrassment

All because of a missed annual form.

Conclusion

DIR-3 KYC is not optional.

It is the lifeline of a director’s DIN.

Timely DIR-3 KYC:

Keeps DIN active

Avoids penalties

Protects director’s professional credibility

Ignoring it creates instant compliance trouble.

Call to Action

If your DIR-3 KYC is pending or your DIN is deactivated, act immediately to restore compliance before it affects company filings.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com