Why ROC non-compliance leads to heavy additional fees and prosecution

Introduction

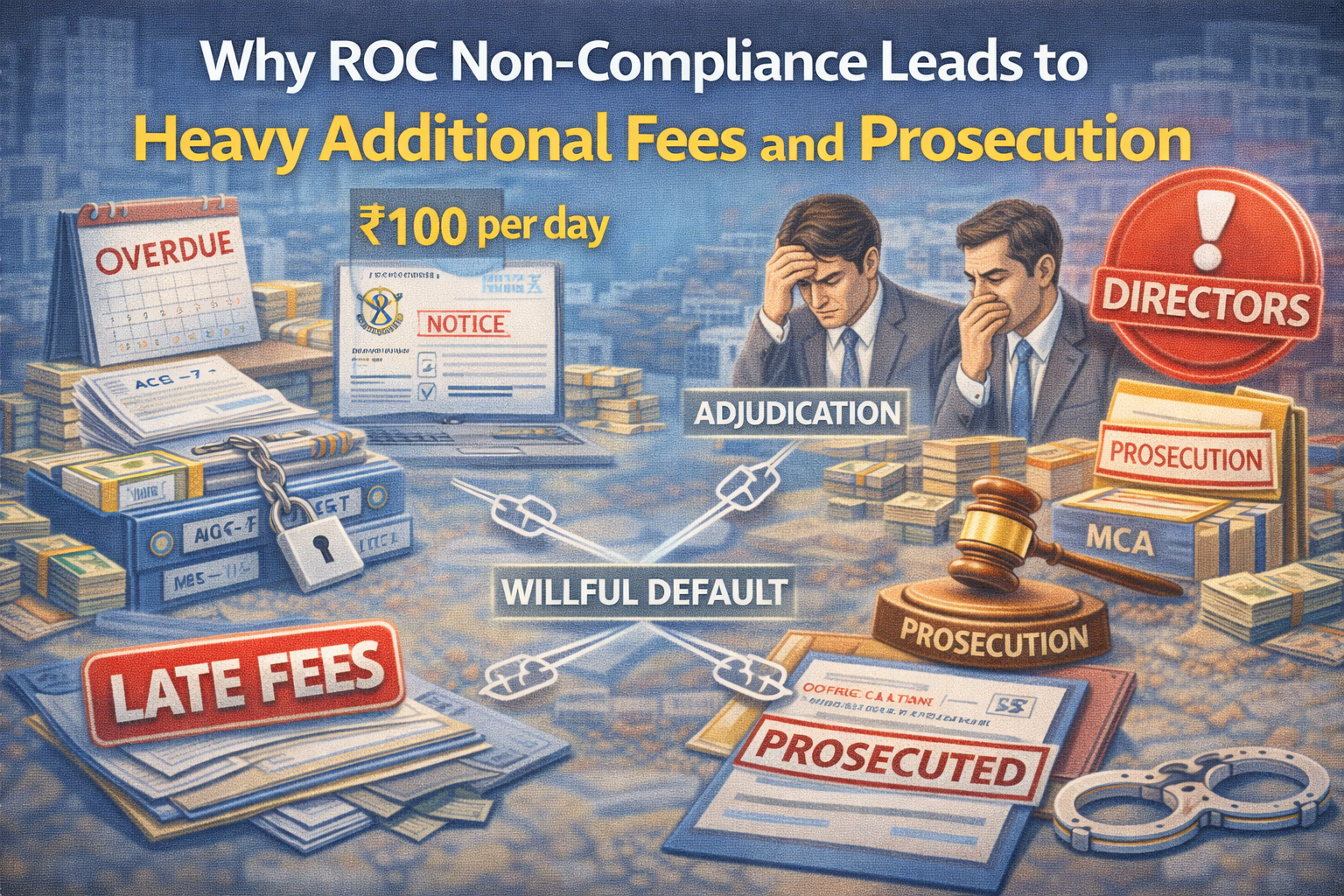

Many companies ignore ROC compliance thinking penalties will be small or manageable later.

That assumption is expensive.

ROC non-compliance does not just attract late fees. Over time, it leads to heavy additional fees, legal notices, and even prosecution of directors.

This blog explains why ROC treats non-compliance seriously and how small delays turn into major legal trouble.

What Is ROC Non-Compliance

ROC non-compliance means failure to file mandatory returns or forms within prescribed timelines under the Companies Act, 2013.

Common defaults include:

Non-filing of AOC-4 and MGT-7

Delay in DIR-3 KYC

Non-reporting of director or share capital changes

Failure to update registered office address

All such defaults are tracked by the Registrar of Companies electronically.

Why ROC Imposes Heavy Additional Fees

ROC compliance is time-bound by law, not discretionary.

Late fees are designed to:

Force timely compliance

Prevent misuse of corporate structure

Ensure transparency and accountability

That’s why most ROC forms carry per-day penalties, often without any maximum cap.

How Small Defaults Turn into Heavy Fees

1. Per-Day Late Fee Structure

Many ROC forms attract:

₹100 per day

Per form

Per year

A delay of a few years can easily result in penalties running into lakhs, even for small companies.

2. Multiple Forms, Multiple Years

One year of non-compliance usually means:

AOC-4 not filed

MGT-7 not filed

DIR-3 KYC default

Multiply this by 2–3 years and the penalty snowballs quickly.

Why ROC Initiates Prosecution

When non-compliance continues despite:

Late fee accumulation

Notices

Default history

ROC treats it as willful default, not a mistake.

At this stage, ROC may initiate:

Adjudication proceedings

Prosecution under Companies Act

Personal liability on directors and officers

This is where compliance becomes a legal problem.

Director Liability in ROC Prosecution

Directors are not shielded by the company.

ROC can:

Issue show-cause notices to directors

Impose penalties personally

Initiate prosecution for continuing default

In serious cases, this can lead to:

Court proceedings

Disqualification risk

Reputational damage

Many directors face prosecution even when the company is inactive.

Common Situations Leading to Prosecution

Non-filing of annual returns for multiple years

Ignoring ROC notices

Struck-off company with unresolved defaults

Wrong assumption that “no business” means no compliance

Most prosecutions arise from long-term neglect, not one-time delay.

Why Ignoring ROC Notices Is Dangerous

ROC notices are legal communications.

Ignoring them can lead to:

Ex-parte orders

Higher penalties

Immediate prosecution

Once prosecution starts, compliance becomes costlier and stressful.

How Companies Can Avoid Heavy Fees and Prosecution

File ROC returns on time every year

Clear pending filings at earliest stage

Respond to ROC notices promptly

Do not wait for prosecution to start

Early compliance costs far less than late correction.

Conclusion

ROC non-compliance is not a harmless delay.

It is a financial and legal risk.

Ignoring ROC obligations leads to:

Heavy additional fees

Director-level liability

Prosecution and legal action

Timely ROC compliance is always cheaper, safer, and smarter.

Call to Action

If your company has pending ROC filings or has received notices, act immediately. Delaying further can turn a compliance issue into a prosecution matter.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com