Why Income-tax Act, 1961 Was Replaced by Income-tax Act, 2025

Introduction

The Income-tax Act, 1961 governed India’s direct taxation system for more than six decades. While the Act provided a strong legal foundation, continuous amendments over the years made it lengthy, complex, and difficult to interpret. To address these challenges, the Government introduced the Income-tax Act, 2025 with a focus on simplification and structural clarity.

The replacement does not indicate failure of the 1961 Act but reflects the need to modernise tax laws in line with present-day requirements.

Challenges Faced Under Income-tax Act, 1961

Over time, the Income-tax Act, 1961 faced several practical challenges:

Frequent amendments leading to complexity

Multiple provisos, explanations, and exceptions

Difficulty in understanding section inter-linkages

Increased litigation due to ambiguous drafting

High compliance burden for taxpayers and professionals

These issues made tax compliance increasingly technical and time-consuming.

Need for a Modern and Simplified Tax Law

India’s economy has evolved significantly since 1961. Digital transactions, faceless assessments, electronic filing, and advanced compliance systems required a tax law that matched modern administrative practices.

The Income-tax Act, 2025 was designed to:

Simplify statutory language

Reorganise provisions logically

Remove redundant and obsolete sections

Improve transparency and ease of compliance

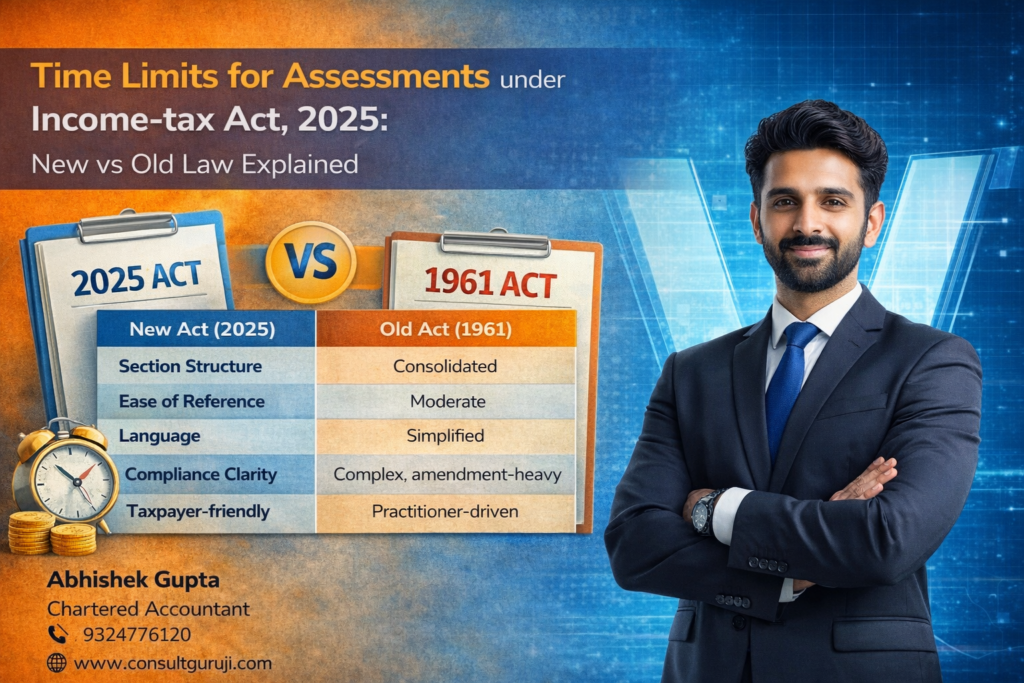

Structural Improvements in Income-tax Act, 2025

1. Reorganisation of Sections

Provisions have been regrouped to place related concepts together, making navigation easier.

2. Clear and Concise Drafting

Long sentences and layered explanations have been replaced with simpler drafting.

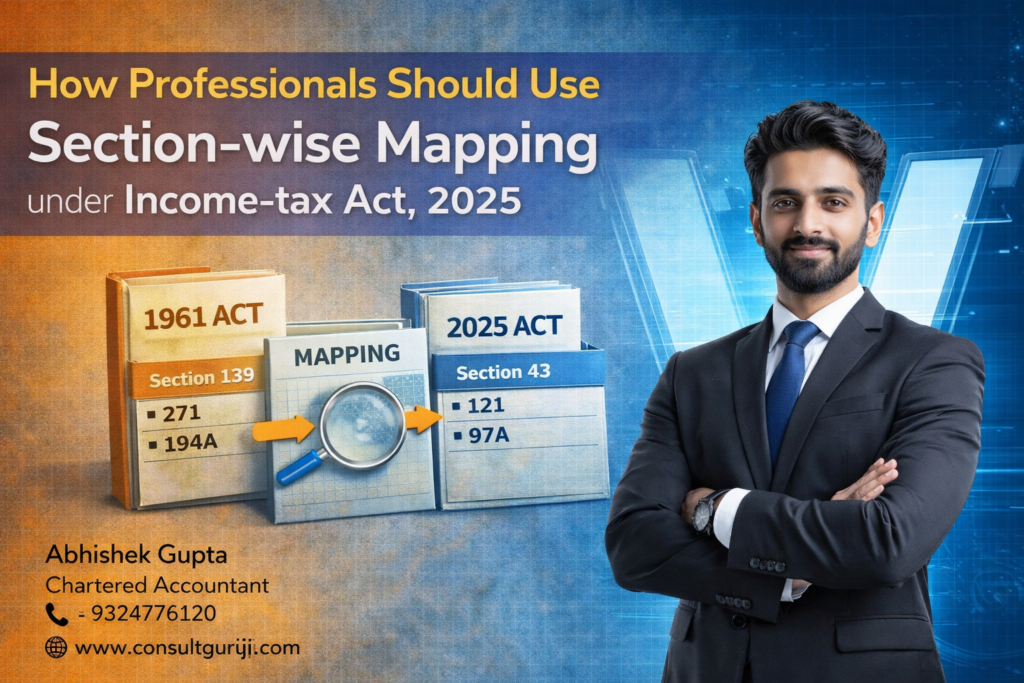

3. Section-wise Mapping for Continuity

A detailed mapping between the 1961 Act and 2025 Act ensures professionals can transition smoothly without losing legal continuity.

What Has Not Changed Despite the Replacement

Despite the new Act:

Core tax principles remain unchanged

Heads of income continue as before

Assessment and appeal mechanisms remain familiar

Tax rates are not altered merely due to restructuring

The focus is on clarity, not increased taxation.

Impact on Taxpayers and Professionals

For taxpayers, the new Act offers better understanding and easier compliance.

For professionals, it reduces interpretational challenges and allows more efficient advisory and litigation support.

Early adaptation will help professionals and businesses avoid confusion during the transition phase.

Conclusion

The Income-tax Act, 1961 was replaced by the Income-tax Act, 2025 to modernise India’s tax framework and address long-standing complexity issues. The new Act aims to create a cleaner, more structured, and user-friendly tax law without disturbing established taxation principles.

Written by:

Abhishek Gupta

G Abhishek And Associates

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com