Objectives of Income-tax Act, 2025 Explained

Introduction

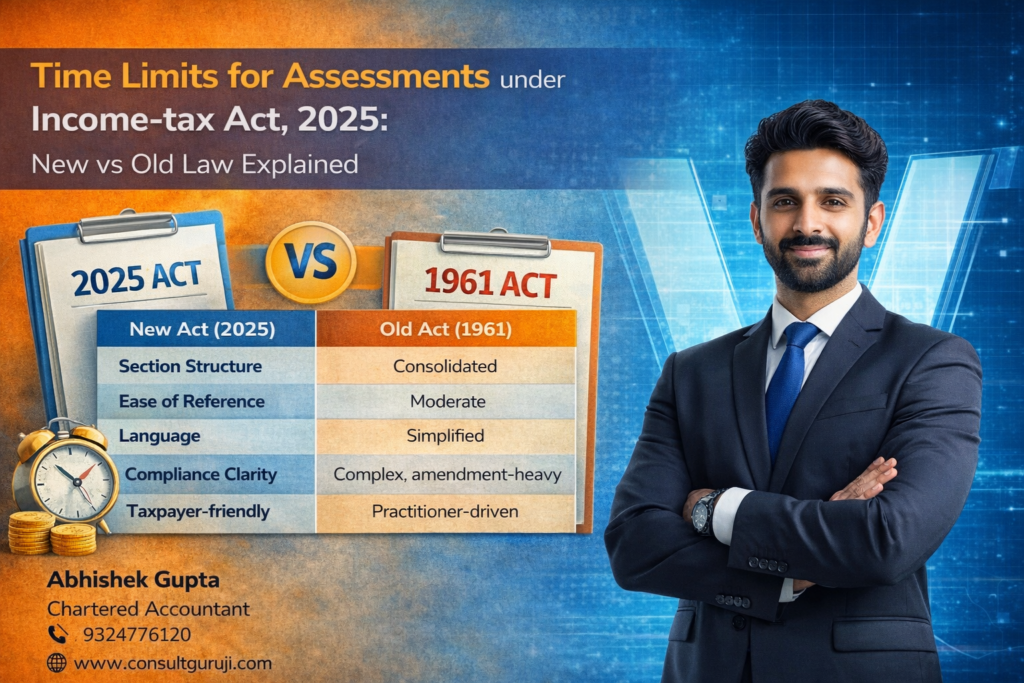

The Income-tax Act, 2025 has been introduced with a clear intention to modernise and simplify India’s direct tax law. While the fundamental principles of taxation remain unchanged, the new Act focuses on improving structure, clarity, and ease of compliance for taxpayers and professionals.

Understanding the objectives behind the Income-tax Act, 2025 helps in appreciating why this reform was necessary and how it aims to improve the overall tax ecosystem.

Objective 1: Simplification of Tax Law

One of the primary objectives of the Income-tax Act, 2025 is to simplify the existing tax law. Over decades, frequent amendments to the Income-tax Act, 1961 made the law lengthy and complex.

The new Act aims to:

Use simpler and clearer language

Reduce multiple provisos and explanations

Make provisions easier to read and interpret

Simplification helps taxpayers comply with the law without excessive technical difficulty.

Objective 2: Logical Re-structuring of Provisions

The Income-tax Act, 2025 reorganises sections in a more logical manner. Related provisions are grouped together, making navigation easier for users.

This restructuring ensures:

Better flow of sections

Faster identification of applicable provisions

Reduced confusion during compliance and litigation

Objective 3: Reduction in Litigation

Ambiguous drafting under the old Act often resulted in multiple interpretations and prolonged litigation. One of the key objectives of the new Act is to reduce such disputes.

By improving clarity and removing unnecessary complexity, the Act aims to:

Minimise interpretational issues

Reduce avoidable tax disputes

Improve certainty in tax administration

Objective 4: Ease of Compliance for Taxpayers

The Income-tax Act, 2025 focuses strongly on taxpayer convenience. Clear provisions and structured sections help taxpayers understand their obligations more easily.

This objective supports:

Voluntary compliance

Accurate return filing

Reduced dependence on technical assistance for basic compliance

Objective 5: Continuity Without Changing Core Principles

A crucial objective of the Income-tax Act, 2025 is to maintain continuity. The Act does not intend to introduce drastic changes in tax principles.

Key aspects that remain unchanged include:

Heads of income

Core assessment framework

Appeal and compliance mechanisms

The reform is structural rather than substantive.

Objective 6: Alignment with Modern Tax Administration

With digitisation, faceless assessments, and electronic compliance becoming the norm, the tax law needed alignment with modern administrative practices.

The Income-tax Act, 2025 supports:

Digital tax administration

Transparent procedures

Efficient and accountable governance

Conclusion

The objectives of the Income-tax Act, 2025 clearly reflect the Government’s intention to create a simpler, clearer, and more taxpayer-friendly tax law. By focusing on simplification, logical structure, reduced litigation, and ease of compliance, the new Act aims to strengthen India’s direct tax framework without altering its core principles.

Written by

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com