Residential Status under Income-tax Act, 2025: New Sections vs Old Sections Explained

Introduction

Residential status plays a crucial role in determining the scope of taxable income in India. It decides whether a person is taxed only on Indian income or on global income as well. Under the Income-tax Act, 2025, the concept of residential status continues from the Income-tax Act, 1961, but with better structure and clearer drafting.

This article explains residential status under the new Act and its section-wise comparison with the old Act.

Why Residential Status Is Important

Residential status determines:

Scope of total income

Taxability of foreign income

Applicability of Double Taxation Avoidance Agreements (DTAA)

Incorrect determination of residential status can lead to wrong tax computation and litigation.

Residential Status under Income-tax Act, 1961

Under the Income-tax Act, 1961:

Sections 6 and 7 governed residential status

Taxpayers were classified as:

Resident and Ordinarily Resident (ROR)

Resident but Not Ordinarily Resident (RNOR)

Non-Resident (NR)

Residential status depended on stay in India during the previous year and preceding years.

Residential Status under Income-tax Act, 2025

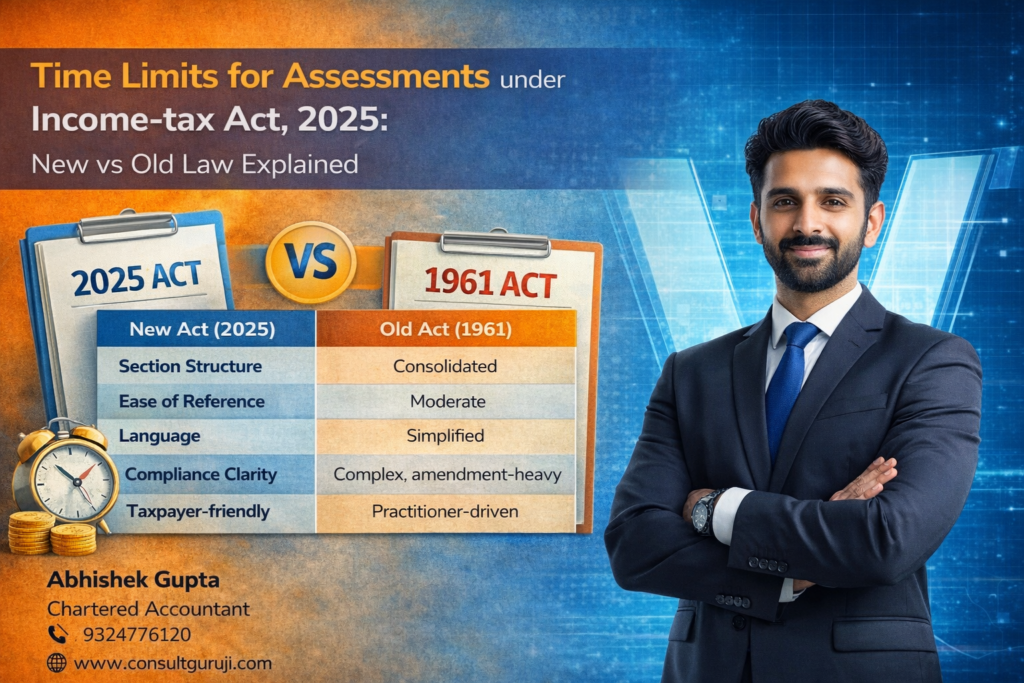

The Income-tax Act, 2025 retains the same core principles of residential status. However:

Provisions are rearranged and renumbered

Language is simplified

Related concepts are placed together for clarity

There is no fundamental change in conditions for determining residential status.

New Sections vs Old Sections – Conceptual Mapping

Concept Income-tax Act, 1961 Income-tax Act, 2025

Basic test of residence Section 6 Corresponding section under 2025 Act

Categories of residents ROR, RNOR, NR Same categories retained

Basis of stay Physical presence Physical presence

Link with scope of income Yes Yes

This mapping ensures continuity and applicability of earlier judicial rulings.

Taxability Based on Residential Status

Resident

Taxable on income earned in India

Taxable on income earned outside India

Resident but Not Ordinarily Resident

Taxable on Indian income

Limited taxability of foreign income

Non-Resident

Taxable only on income received or accruing in India

These principles remain unchanged under the new Act.

What Has Changed under Income-tax Act, 2025

The changes are mainly:

Structural and drafting-related

Improved clarity in presentation

Better linkage with scope of total income provisions

There is no expansion of tax base due to the new Act.

Importance of Section-wise Understanding

Understanding section-wise mapping helps professionals:

Apply old case laws to new sections

Handle assessments and appeals effectively

Ensure accurate compliance under the new law

Conclusion

The residential status provisions under the Income-tax Act, 2025 maintain continuity with the Income-tax Act, 1961 while offering a cleaner and more logical structure. The section-wise mapping ensures that taxpayers and professionals can transition smoothly without confusion or disruption.

Written by

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com