Transitional Issues: Income-tax Act 1961 to 2025

Introduction

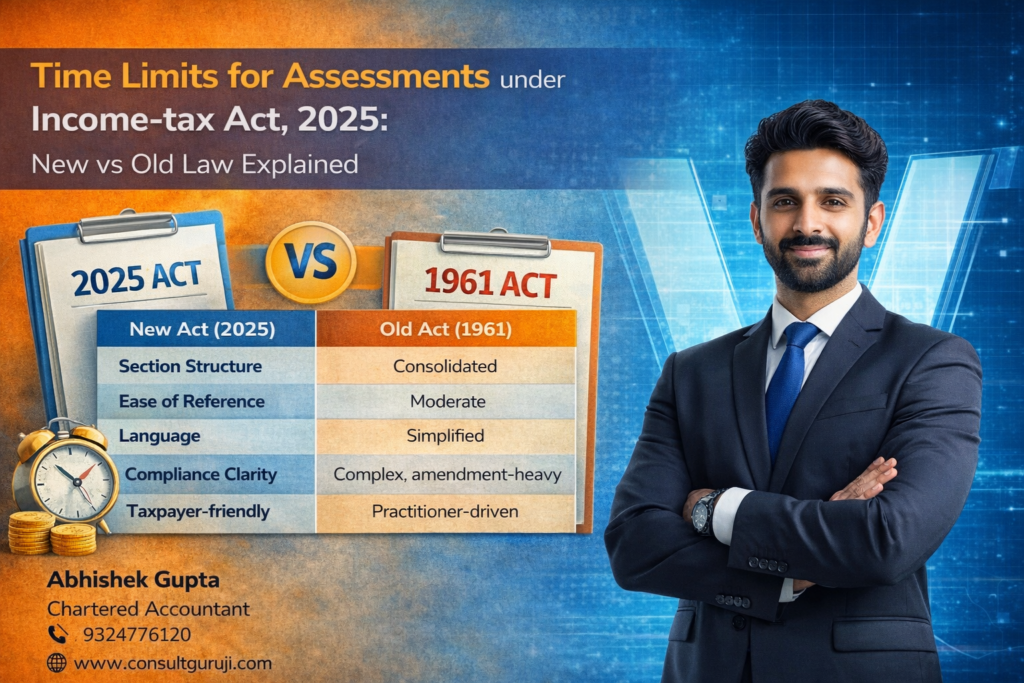

With the introduction of the Income-tax Act, 2025, India has moved towards a simplified and reorganised direct tax framework. While the new Act aims to improve clarity and compliance, the transition from the Income-tax Act, 1961 raises several practical and legal issues for taxpayers, professionals, and authorities.

This article explains the key transitional issues that arise during the shift from the old law to the new Act.

1. Pending Assessments and Proceedings

All assessments, reassessments, appeals, penalty, and prosecution proceedings initiated under the Income-tax Act, 1961 will continue to be governed by the provisions of the old Act unless specifically transitioned under the 2025 Act.

What this means in practice:

Notices issued before the appointed date remain valid

Rights and obligations of taxpayers remain unchanged

Authorities will complete proceedings under old sections

2. Carry Forward of Losses and Unabsorbed Depreciation

Losses and unabsorbed depreciation computed under the 1961 Act can be carried forward under the Income-tax Act, 2025, subject to existing conditions.

Key points:

No fresh computation required

Period of carry forward remains unchanged

Set-off allowed as per transitional provisions

3. Credits, Refunds, and Adjustments

Tax credits such as:

TDS

TCS

Advance tax

Self-assessment tax

paid under the old Act will be fully recognised under the new Act.

Refunds arising out of earlier years will be processed as per old provisions but paid under the new administrative framework.

4. Ongoing Appeals and Litigation

Appeals filed before:

Commissioner (Appeals)

ITAT

High Court

Supreme Court

will continue under the procedural law applicable at the time of filing.

The 2025 Act does not disturb vested appellate rights.

5. Penalty and Prosecution Matters

Penalty and prosecution proceedings initiated under the 1961 Act will:

Continue under the same sections

Be governed by the old thresholds, safeguards, and timelines

No retrospective application of new penalty or prosecution provisions is intended.

6. Subordinate Legislation and Rules

Rules, notifications, circulars, and instructions issued under the 1961 Act will remain effective until replaced or modified under the 2025 Act.

This ensures continuity and avoids regulatory gaps during transition.

7. Compliance and Practical Challenges

During the transition phase, taxpayers may face:

Confusion in section references

Dual interpretation issues

System and reporting mismatches

Professional guidance becomes critical to avoid procedural lapses.

Conclusion

The Income-tax Act, 2025 focuses on structural simplification, not disruption. Transitional provisions ensure continuity, protect taxpayer rights, and provide certainty during migration from the 1961 Act.

Understanding these transitional issues is essential for smooth compliance and effective tax planning in the new regime.

Need Professional Help?

If you have pending assessments, appeals, or compliance issues spanning both Acts, expert advice can save time, cost, and litigation risk.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com