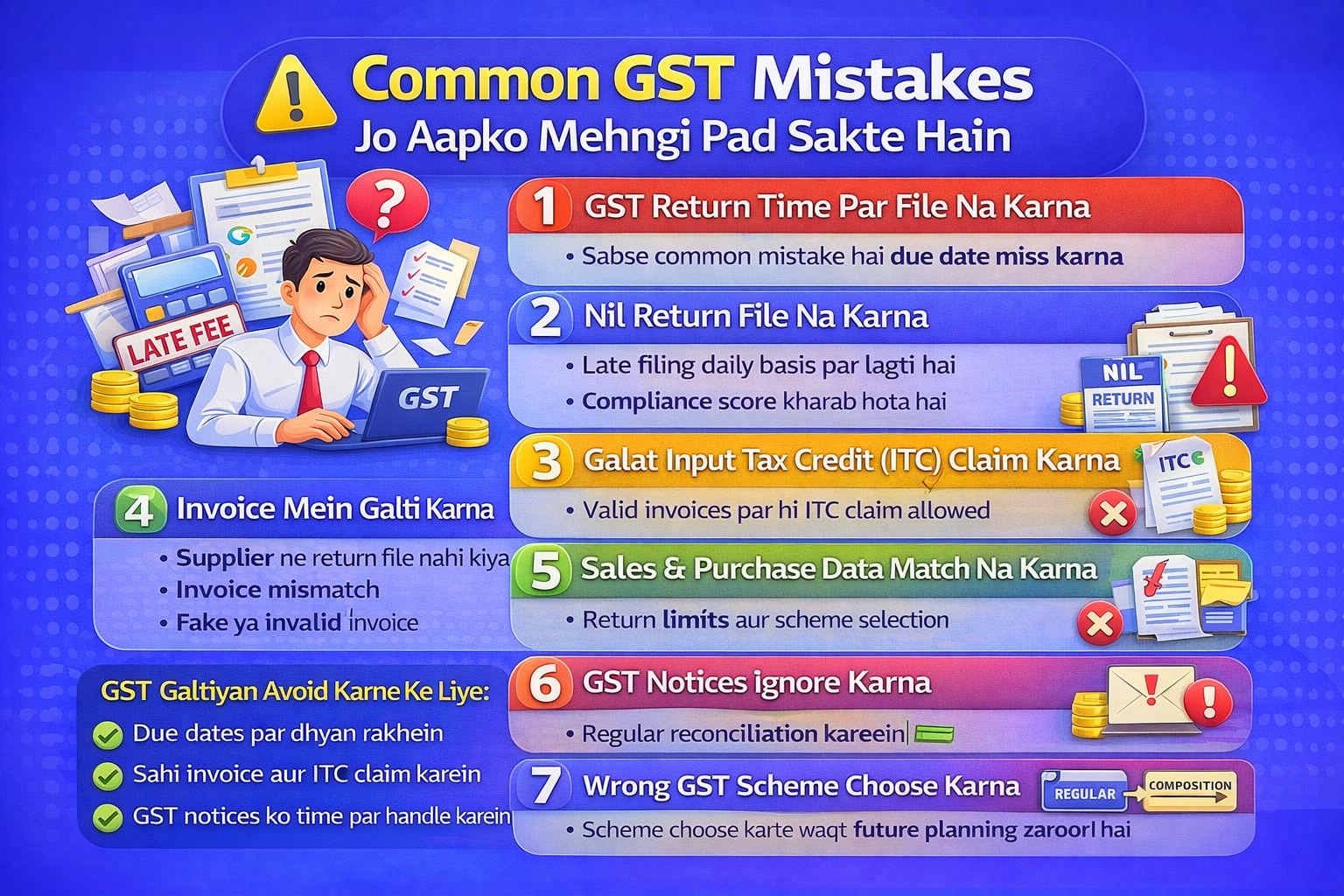

Common GST Mistakes Jo Aapko Mehngi Pad Sakte Hain

Common GST Mistakes Jo Aapko Mehngi Pad Sakte Hain

GST compliance thodi si galti ki wajah se late fee, penalty ya ITC loss ka reason ban sakti hai. Bahut saare business owners ye mistakes unknowingly kar dete hain, jinka nuksan baad mein mehnga padta hai.

Is post mein hum common GST mistakes aur unse bachne ke tarike samjhenge.

1️⃣ GST Return Time Par File Na Karna

Sabse common mistake hai due date miss karna.

Late fee daily basis par lagti hai

Interest bhi charge hota hai

Compliance score kharab hota hai

✅ Solution: Due dates ka calendar maintain karein.

2️⃣ Nil Return File Na Karna

Agar kisi month sale nahi hui, tab bhi Nil Return file karna mandatory hota hai.

❌ File na karne par late fee lagegi

✅ Har period ka return file karein

3️⃣ Galat Input Tax Credit (ITC) Claim Karna

Supplier ne return file nahi kiya

Invoice mismatch

Fake ya invalid invoice

❌ ITC reject ho sakti hai + penalty

✅ Sirf verified invoices par ITC claim karein

4️⃣ Invoice Mein Galti Karna

Galat GST rate

HSN / SAC code missing

Buyer ya seller GSTIN galat

❌ Return mismatch aur notice aa sakta hai

✅ Proper GST invoice format follow karein

5️⃣ Sales & Purchase Data Match Na Karna

Books of accounts aur GST returns ka data agar match nahi karta to problem hoti hai.

✅ Regular reconciliation karein

6️⃣ GST Notices Ignore Karna

GST portal par aane wale notices ko ignore karna bahut mehnga pad sakta hai.

❌ Penalty aur legal action

✅ Time par reply karein

7️⃣ Wrong GST Scheme Choose Karna

Composition aur Regular GST ka galat selection business growth ko affect kar sakta hai.

✅ Scheme choose karte waqt future planning zaroori hai

Conclusion

GST mistakes avoid karna mushkil nahi hai, bas discipline, timely filing aur sahi guidance chahiye. Chhoti si galti bhi bada financial loss karwa sakti hai.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞9324776120

🌐 www.consultguruji.com