Deductions under Income-tax Act, 2025: Section-wise Mapping with 1961 Act

Introduction

Deductions play a crucial role in reducing taxable income and encouraging savings, investments, and social welfare spending. Under the Income-tax Act, 2025, the government has reorganised and renumbered deduction-related provisions of the Income-tax Act, 1961 to make them easier to understand and apply.

Although the benefits and conditions of deductions largely remain unchanged, taxpayers and professionals must understand the new section-wise mapping to ensure correct compliance under the new law.

What are Deductions under the Income-tax Act?

Deductions are specific amounts allowed to be reduced from Gross Total Income to arrive at Total Taxable Income. These deductions are provided to promote:

Savings and investments

Insurance and retirement planning

Health and education expenditure

Social and economic development

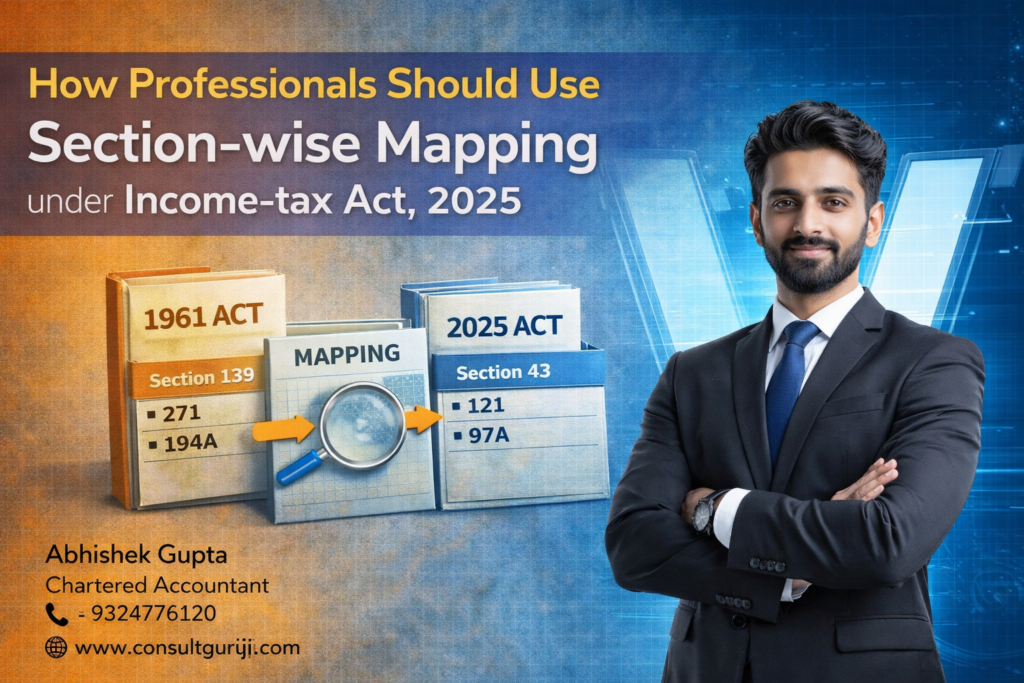

Section-wise Mapping: Old Act vs New Act

Category Income-tax Act, 1961 Income-tax Act, 2025

Deductions from Gross Total Income Chapter VI-A Re-structured Chapter

Life Insurance, PF, Investments Section 80C Corresponding mapped section

Pension Schemes Sections 80CCC, 80CCD Consolidated pension provisions

Medical Insurance Section 80D Re-organised section

Interest on Education Loan Section 80E Mapped provision

Donations Section 80G Grouped deduction section

Disability & Medical Treatment Sections 80DD, 80DDB Simplified structure

Interest on Savings Section 80TTA / 80TTB Re-grouped sections

(Only section numbers and placement have changed; deduction benefits remain intact.)

Major Deductions under Income-tax Act, 2025

1. Investment-linked Deductions

Investments in instruments such as life insurance, provident fund, ELSS, and other notified schemes continue to qualify for deduction under the new Act.

2. Retirement and Pension Deductions

Contributions to pension schemes and notified retirement plans remain eligible, with provisions presented in a clearer and consolidated manner.

3. Health-related Deductions

Medical insurance premiums, preventive health check-ups, and specified medical treatments are still allowed subject to prescribed limits.

4. Education and Housing-related Deductions

Interest on education loans and eligible housing loan interest deductions continue with no substantive change.

5. Donations and Social Contributions

Donations to approved charitable institutions and funds remain deductible, with improved classification under the new Act.

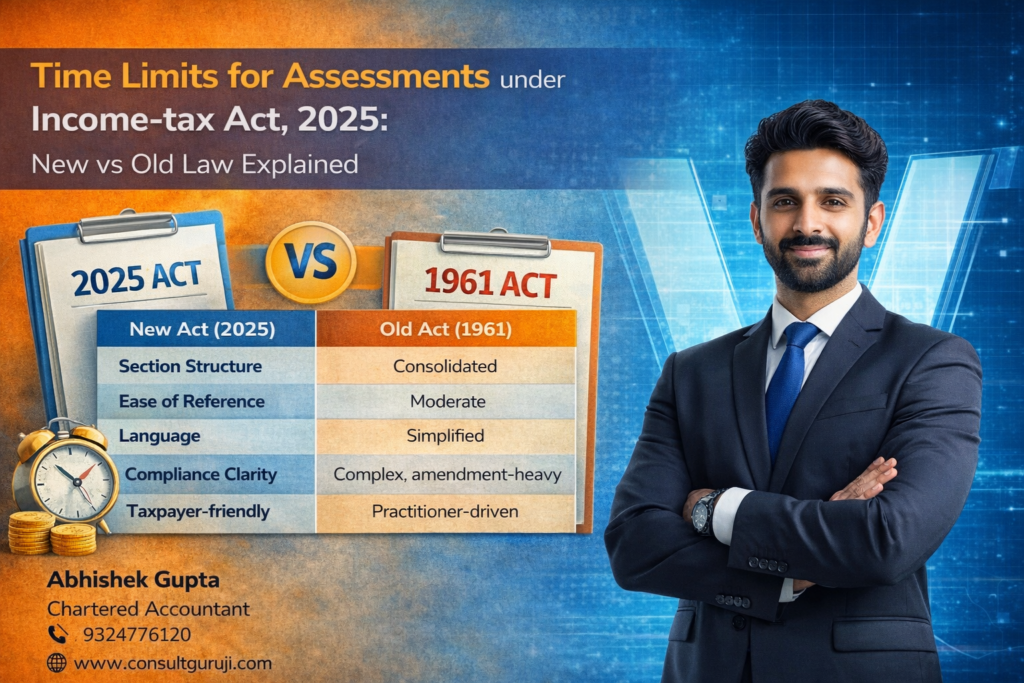

What Has Changed in Income-tax Act, 2025?

Simplified structure of Chapter VI-A

Logical grouping of similar deductions

Reduced cross-referencing across sections

Easier identification of eligible deductions

There is no withdrawal of major deductions solely due to the introduction of the new Act.

Impact on Taxpayers

For individual taxpayers:

No loss of deduction benefits

Easier understanding of deduction provisions

Smoother tax return preparation

Reduced confusion due to renumbering

For professionals, the new structure allows faster reference and cleaner compliance.

Conclusion

Deductions under the Income-tax Act, 2025 continue to offer the same tax-saving opportunities as under the 1961 Act, but in a better organised and more readable format. Understanding the new section-wise mapping is essential for accurate tax planning and compliance in the coming years.

Taxpayers should focus on eligibility and conditions, rather than just old section numbers, while adapting to the new law.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com