Income from Other Sources: Changes in Section Numbers Explained (Income-tax Act, 2025)

Introduction

Income from Other Sources is a residual head of income under the Income-tax law. Any income that does not fall under Salary, House Property, Business or Profession, or Capital Gains is taxed under this head.

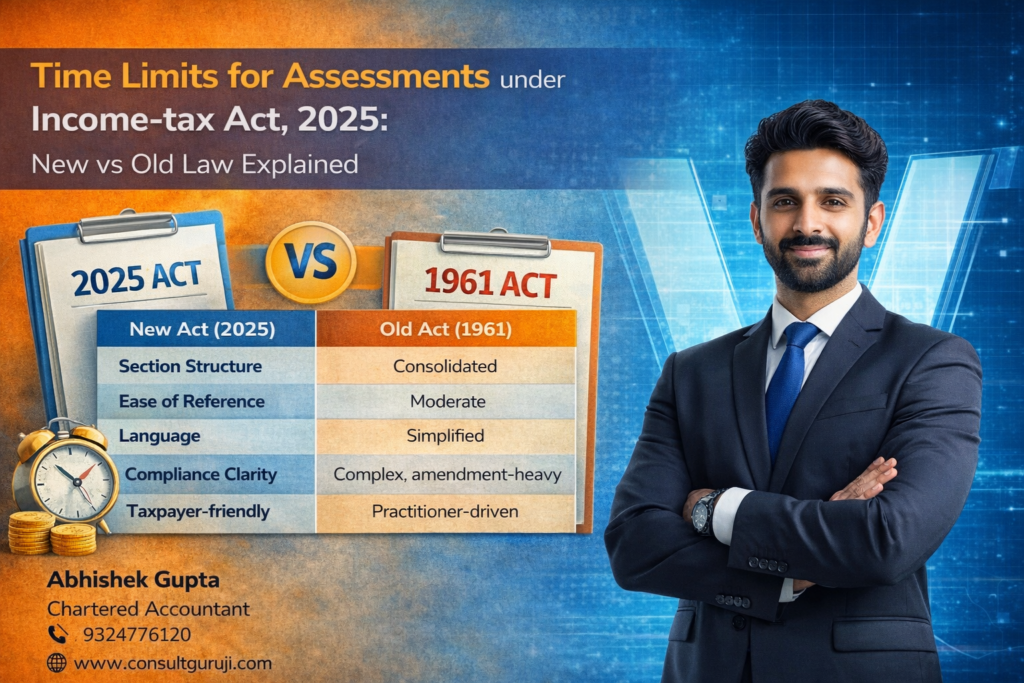

With the introduction of the Income-tax Act, 2025, the government has renumbered and reorganised provisions relating to Income from Other Sources to improve clarity and ease of reference. While the taxability rules remain largely unchanged, understanding the new section structure is important for correct compliance.

What is Income from Other Sources?

Income from Other Sources covers incomes which are not specifically taxable under any other head. This ensures that no income escapes taxation merely due to classification issues.

Common examples include:

Interest income

Dividend income

Gifts taxable under the Act

Family pension

Winnings from lotteries, games, and betting

Certain receipts without consideration

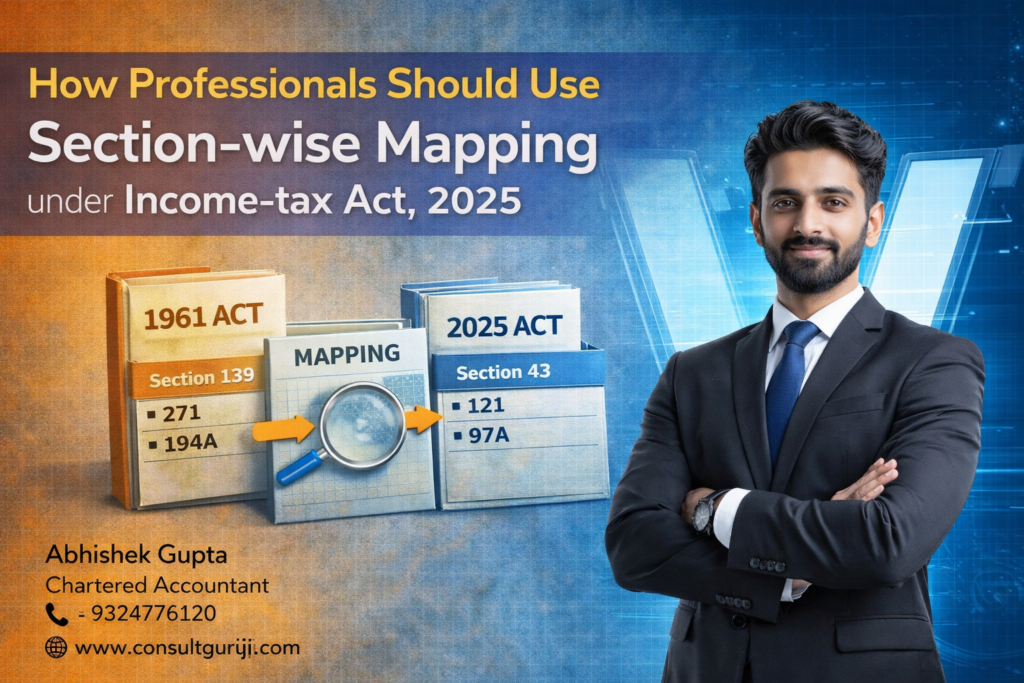

Section-wise Mapping: Old Act vs New Act

Particulars Income-tax Act, 1961 Income-tax Act, 2025

Charge of Income Section 56 Re-numbered structured section

Specific Incomes taxable Section 56(2) Consolidated provisions

Dividend Income Section 56(2)(i) Re-organised section

Gifts & Deemed Income Section 56(2)(x) Simplified grouping

Deductions Section 57 Corresponding deduction section

Disallowances Section 58 Re-mapped provisions

(Only section numbers and structure have changed; principles remain the same.)

Types of Income Covered under Income-tax Act, 2025

1. Interest Income

Interest from savings accounts, fixed deposits, loans, and other securities is taxable unless exempted.

2. Dividend Income

Dividends received from companies or mutual funds are taxable under this head.

3. Gifts and Receipts without Consideration

Money or property received without consideration beyond prescribed limits is taxable, subject to specified exemptions.

4. Family Pension

Family pension received by legal heirs is taxable under Income from Other Sources with standard deduction.

5. Winnings and Casual Income

Winnings from lotteries, crossword puzzles, card games, betting, and similar activities are taxable at special rates.

Deductions Available

The Income-tax Act, 2025 allows limited deductions under this head, including:

Collection charges for dividend or interest income

Interest on borrowed funds used to earn taxable income

Standard deduction from family pension

The new Act presents these deductions in a clearer and more consolidated format.

What Has Changed in the Income-tax Act, 2025?

Simplified and logical grouping of provisions

Better clarity on deemed income

Easier identification of taxable receipts

Reduced cross-referencing between sections

Importantly, there is no change in tax rates or basic taxability rules.

Impact on Taxpayers

For taxpayers:

No change in tax burden

Easier understanding of income classification

Reduced confusion during return filing

Improved assessment clarity

Tax professionals will find the new structure more user-friendly during scrutiny and appellate proceedings.

Conclusion

Income from Other Sources under the Income-tax Act, 2025 continues to act as a comprehensive residual head of income. While the section numbers have changed, the substance of taxation remains intact. Familiarity with the new section mapping will help taxpayers and professionals ensure accurate compliance under the new law.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com