Introduction to Income-tax Act, 2025: What Has Changed from Income-tax Act, 1961

Introduction

The Income-tax Act, 2025 has been introduced with the objective of simplifying India’s direct tax law and making it more structured, readable, and user-friendly. After more than six decades of operation, the Income-tax Act, 1961 had become complex due to frequent amendments, multiple provisos, and layered explanations.

The new Act does not aim to overhaul taxation principles but focuses on restructuring and clarity, ensuring that taxpayers and professionals can understand and comply with the law more easily.

Why the Income-tax Act, 1961 Needed Change

The Income-tax Act, 1961 served the country well, but over time it faced several challenges:

Excessive amendments over the years

Complex drafting and lengthy provisions

Difficulty in locating relevant sections

Increased litigation due to interpretational issues

These issues made compliance difficult, especially for small taxpayers and businesses.

Key Objectives of Income-tax Act, 2025

The Income-tax Act, 2025 has been designed with the following objectives:

Simplification of language

Logical re-arrangement of sections

Removal of redundant and outdated provisions

Better alignment of related provisions

Reduction in ambiguity and litigation

The focus is on ease of understanding rather than change in tax burden.

Major Structural Changes from 1961 Act

1. Re-numbering and Re-grouping of Sections

Sections have been reorganised to bring similar provisions together. This makes the Act easier to navigate and apply.

2. Streamlined Drafting

Multiple explanations and provisos have been merged into clearer provisions, improving readability.

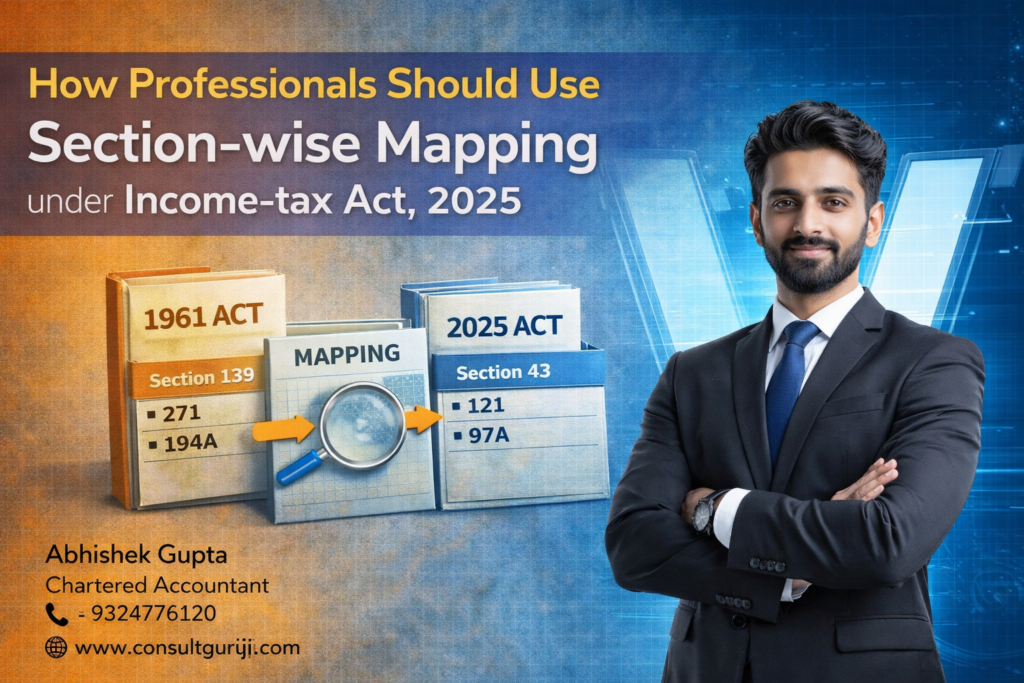

3. Section-wise Mapping

A detailed mapping has been provided to correlate sections of the Income-tax Act, 2025 with the Income-tax Act, 1961, ensuring smooth transition for professionals.

What Has Not Changed

It is important to note that:

Core taxation concepts remain intact

Heads of income continue as before

Assessment, appeal, and compliance frameworks remain largely consistent

Tax rates are not changed merely due to the new Act

The reform is structural, not substantive.

Impact on Taxpayers and Professionals

For taxpayers, the new Act offers clarity and easier compliance.

For professionals, it reduces time spent on interpretation and improves accuracy in advisory and litigation work.

Understanding the changes early will help professionals transition smoothly as the new Act becomes operational.

Conclusion

The Income-tax Act, 2025 represents a shift toward a cleaner, more organised, and taxpayer-friendly tax law. While the substance of taxation remains largely the same, the structural improvements mark a significant step toward reducing complexity and improving compliance in India’s tax system.

Written by

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com