Penalty Provisions: Income-tax Act 2025 vs 1961

Introduction

Penalty provisions play a critical role in ensuring tax compliance. Over the years, frequent amendments under the Income-tax Act, 1961 made penalty-related sections complex and litigation-prone.

The Income-tax Act, 2025 restructures these provisions with clearer sectioning, simplified language, and reduced ambiguity—while retaining the same legislative intent.

This article explains how penalty provisions have been reorganised in the new Act and how they compare with the old law.

Penalty Framework under Income-tax Act, 1961

Under the 1961 Act, penalty provisions were spread across multiple sections such as:

Penalty for concealment or furnishing inaccurate particulars

Penalties for failure to comply with notices

Penalties linked with TDS/TCS defaults

Discretion-based penalties leading to inconsistent interpretations

These scattered provisions often resulted in overlapping penalties and higher litigation.

Reorganisation of Penalty Provisions in Income-tax Act, 2025

The 2025 Act introduces a streamlined and structured penalty framework, focusing on:

Logical grouping of penalty sections

Clear distinction between procedural defaults and substantive defaults

Reduced discretionary power

Alignment with faceless and technology-driven assessments

The objective is certainty, transparency, and fairness.

Key Changes: Old Act vs New Act

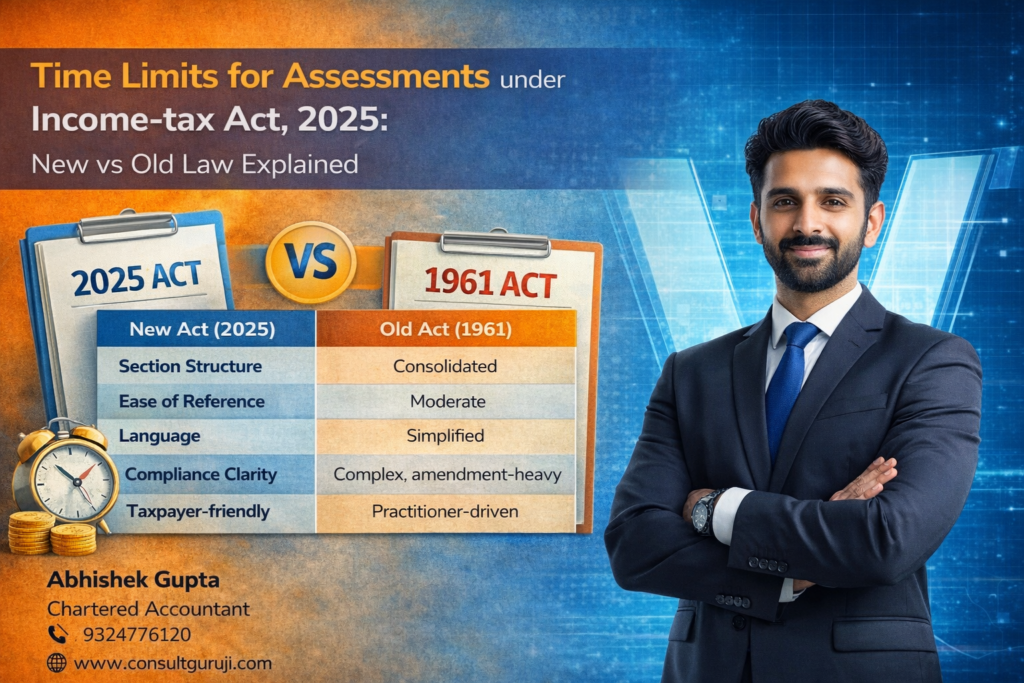

Aspect Income-tax Act, 1961 Income-tax Act, 2025

Structure Scattered sections Consolidated & systematic

Language Technical & complex Simple & precise

Discretion High Rationalised

Litigation risk High Reduced

Compliance focus Punitive Compliance-oriented

Impact on Taxpayers and Professionals

Better clarity on consequences of defaults

Easier compliance planning

Fewer interpretational disputes

Predictable penalty exposure

For professionals, the new structure improves advisory quality and litigation management.

Conclusion

The penalty provisions under the Income-tax Act, 2025 represent a major step towards rational tax administration. By reorganising old sections and simplifying enforcement, the new law aims to encourage voluntary compliance while maintaining deterrence against non-compliance.

Understanding this transition is essential for taxpayers, businesses, and tax professionals alike.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com