Streamlined Structure under Income-tax Act, 2025 Explained

Introduction

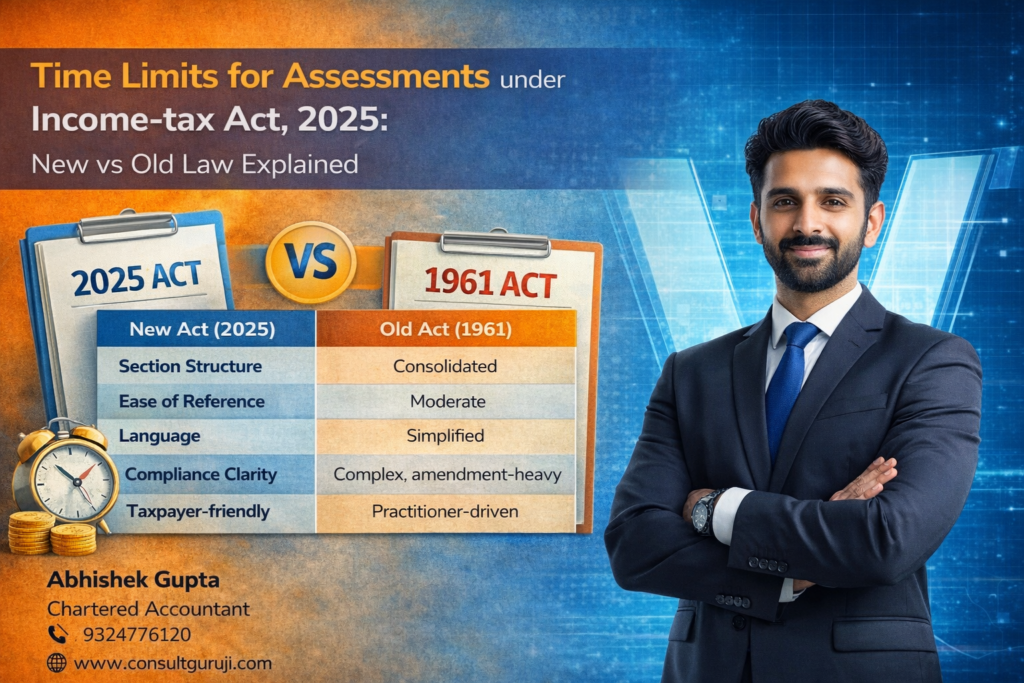

The Income-tax Act, 2025 introduces a streamlined structure to simplify India’s direct tax law. Over the years, the Income-tax Act, 1961 became complex due to frequent amendments, scattered provisions, and multiple explanations. The new Act focuses on reorganising the law in a clearer, more logical, and user-friendly manner.

The streamlined structure does not change the basic principles of taxation but improves how the law is presented and applied.

What Is Meant by Streamlined Structure

A streamlined structure means that the provisions of the Act are:

Logically arranged

Clearly drafted

Grouped by related subject matter

Easy to navigate and interpret

The Income-tax Act, 2025 aims to reduce confusion by placing similar provisions together and removing unnecessary repetition.

Why Streamlining Was Necessary

Under the Income-tax Act, 1961, taxpayers and professionals often faced difficulties such as:

Locating relevant sections

Understanding inter-linked provisions

Interpreting multiple provisos and explanations

Handling increased litigation due to ambiguity

Streamlining addresses these issues by presenting the law in a more structured and systematic format.

Key Features of the Streamlined Structure

1. Logical Grouping of Provisions

Related sections are placed together, making it easier to understand the flow of the law and apply provisions correctly.

2. Simplified Drafting

Complex sentences and overlapping explanations have been reduced, improving readability.

3. Section-wise Reorganisation

Provisions from the 1961 Act have been renumbered and reorganised under the 2025 Act for better clarity, supported by section-wise mapping.

4. Reduced Redundancy

Outdated and repetitive provisions have been removed or merged, making the Act more concise.

Benefits for Taxpayers

For taxpayers, a streamlined structure means:

Better understanding of tax obligations

Easier compliance

Reduced chances of errors

Greater confidence while filing returns

This supports voluntary compliance and reduces dependency on technical interpretation for basic matters.

Benefits for Professionals and Businesses

Chartered Accountants and businesses benefit through:

Faster identification of applicable provisions

Reduced interpretational disputes

Improved efficiency in advisory and litigation work

Better alignment with digital tax administration

Does Streamlining Affect Tax Liability

The streamlined structure does not change tax rates or liability by itself. The reform is structural in nature and focuses on presentation, clarity, and organisation rather than introducing new tax burdens.

Conclusion

The streamlined structure under the Income-tax Act, 2025 represents a major step toward a simpler, clearer, and more efficient tax law. By reorganising provisions logically and simplifying drafting, the new Act improves compliance, reduces litigation, and enhances trust between taxpayers and tax authorities.

Written by

Abhishek Gupta

Chartered Accountant

G Abhishek And Associates

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com