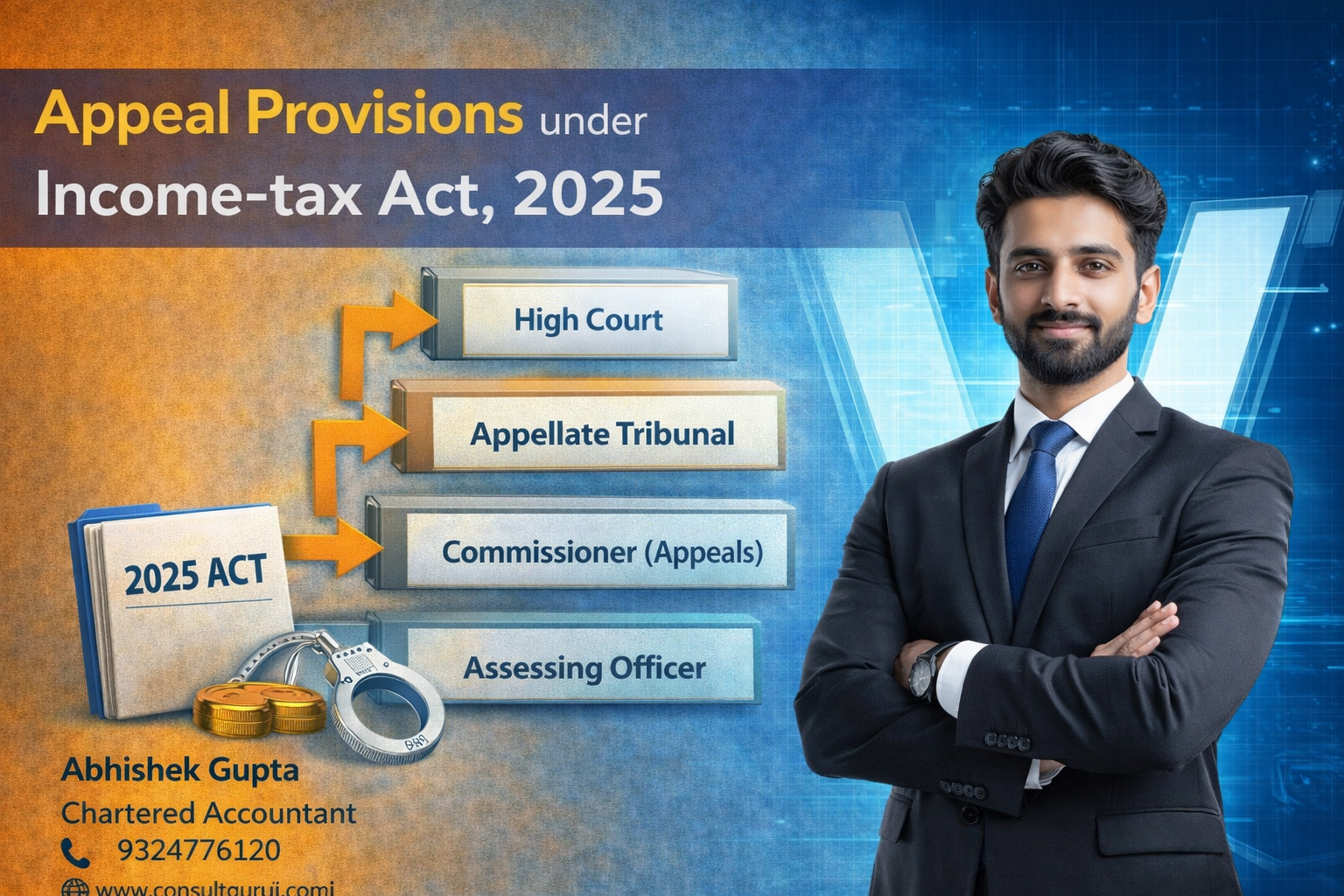

Appeal Provisions under Income-tax Act, 2025

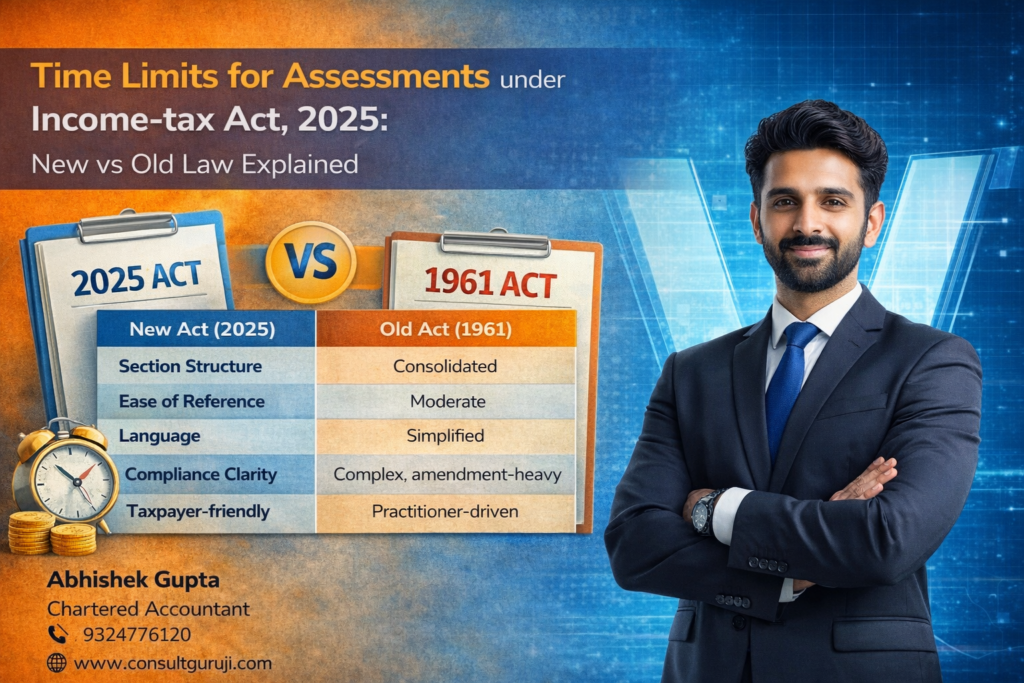

The Income-tax Act, 2025 introduces a restructured and more streamlined framework for filing appeals. While the substantive right to appeal remains unchanged, the new Act focuses on clarity, logical sequencing, and simplified section numbering compared to the Income-tax Act, 1961.

Under the 2025 Act, appeal-related provisions are grouped systematically, making it easier for taxpayers and professionals to identify the correct appellate authority, time limits, and procedural requirements. The structure clearly distinguishes between first appeals, second appeals, revisionary powers, and special remedies.

Key Highlights of Appeal Provisions under the 2025 Act

Clear Hierarchy of Appeals

Appeals are logically arranged from the Assessing Officer to the Commissioner (Appeals), Appellate Tribunal, High Court, and Supreme Court.

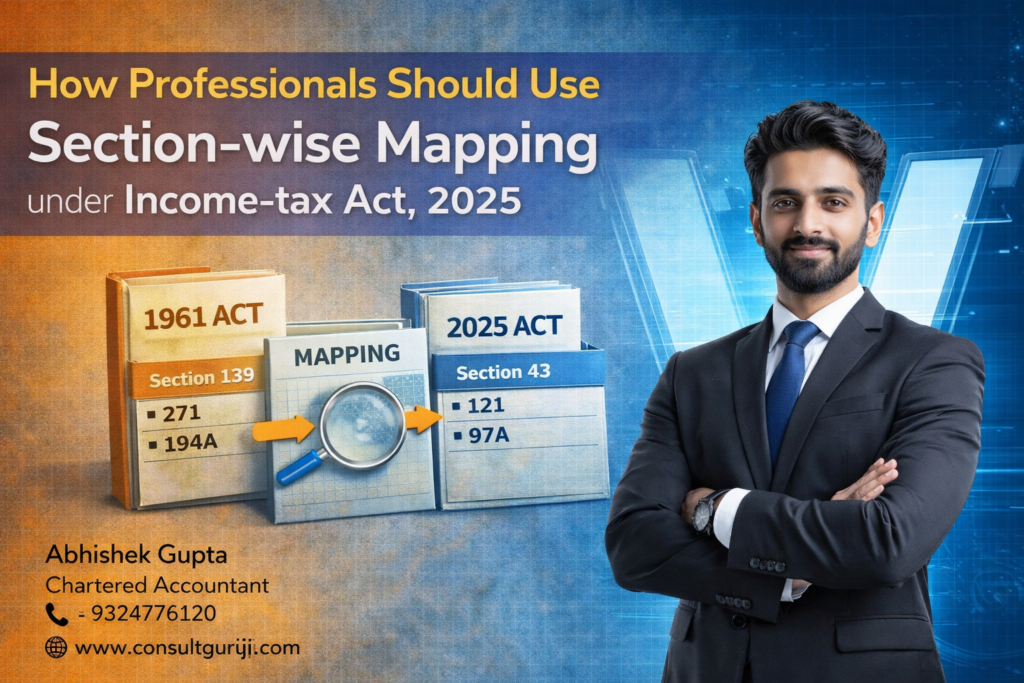

Simplified Section Mapping

Old, scattered sections under the 1961 Act have been reorganised, reducing confusion and overlap.

Digital-First Approach

Electronic filing, faceless proceedings, and digital communication are embedded as default mechanisms.

Defined Time Limits

Time limits for filing appeals, disposal, and rectification are clearly stated to reduce litigation delays.

Enhanced Natural Justice

Mandatory opportunity of being heard and reasoned orders are reinforced under the new structure.

What This Means for Taxpayers

The appeal process under the Income-tax Act, 2025 is more transparent, predictable, and user-friendly. Taxpayers can now track remedies with greater certainty, while professionals benefit from a cleaner legislative layout that reduces interpretational disputes.

Overall, the 2025 Act aims to reduce unnecessary litigation while preserving the taxpayer’s right to challenge incorrect assessments and orders.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com