TCS Provisions under Income-tax Act, 2025: Old Sections vs New Sections Explained

Introduction

Tax Collected at Source (TCS) is an important compliance mechanism under India’s income-tax law, ensuring tax collection at the point of sale of specified goods or receipt of certain payments. Under the Income-tax Act, 2025, TCS provisions have been restructured and renumbered to improve clarity and ease of compliance, while the substantive provisions largely remain unchanged from the Income-tax Act, 1961.

This article explains how TCS provisions have been reorganised in the new Act and maps the old sections with the new ones.

TCS Framework: What Has Changed in 2025 Act

Under the Income-tax Act, 1961, TCS provisions were mainly covered under Section 206C, along with related explanations, provisos, and exceptions added over time. Frequent amendments made the section lengthy and complex.

The Income-tax Act, 2025 aims to:

Break down bulky sections into logically grouped provisions

Use simpler language

Improve section-wise readability

Retain the same compliance intent without changing tax liability

Key Areas Covered under TCS Provisions

The reorganised TCS framework under the 2025 Act continues to cover:

TCS on sale of specified goods

TCS on foreign remittances under LRS

TCS on overseas tour packages

TCS on sale of motor vehicles above prescribed value

Higher TCS rates for non-PAN / non-Aadhaar cases

Adjustments, refunds, and credit of TCS

Only the section numbers and structure have changed.

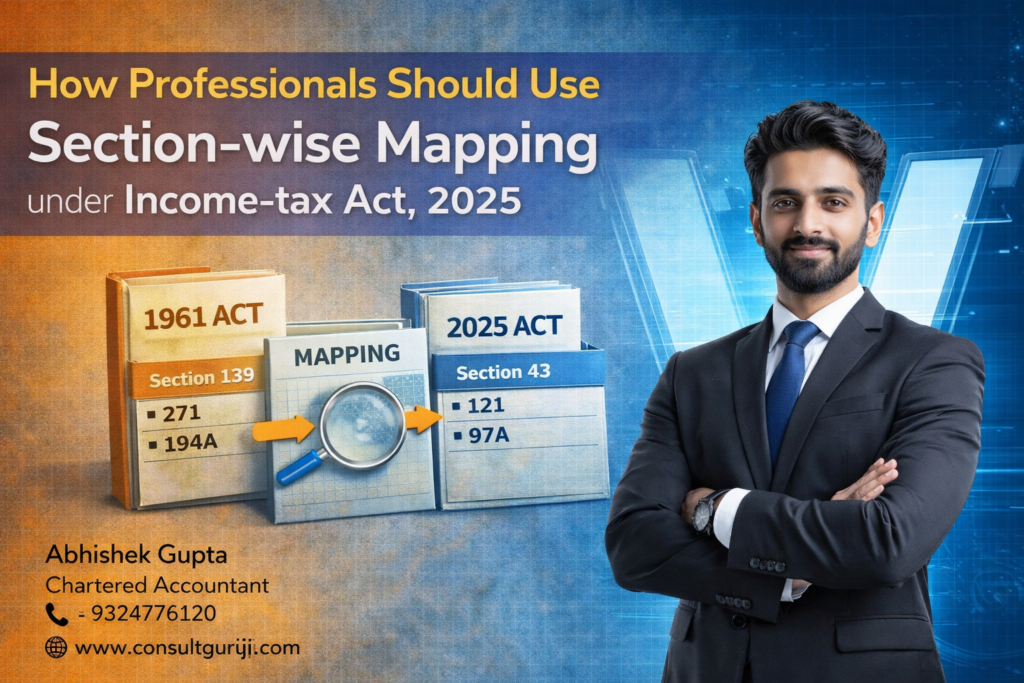

Why Section-wise Mapping Matters

Understanding old vs new section mapping is critical for:

Chartered Accountants and tax professionals

Businesses responsible for TCS compliance

Updating internal SOPs and checklists

Replying to notices and assessments

Training accounts and finance teams

Old section references in contracts, manuals, and legal documents must now be aligned with the new section numbers under the 2025 Act.

Impact on Taxpayers and Businesses

No new tax burden merely due to renumbering

Existing compliance processes remain valid

Better clarity during audits and assessments

Easier interpretation for future amendments

Taxpayers should, however, ensure that returns, challans, and internal references are updated as per the new Act.

Conclusion

The Income-tax Act, 2025 does not reinvent TCS provisions but repackages them in a cleaner and more structured manner. Once professionals understand the section-wise mapping, compliance under the new law becomes smoother and more predictable.

Staying updated with these structural changes is essential to avoid technical errors and ensure seamless tax compliance.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com