TDS Provisions under Income-tax Act, 2025: Section-wise Mapping Explained

Introduction

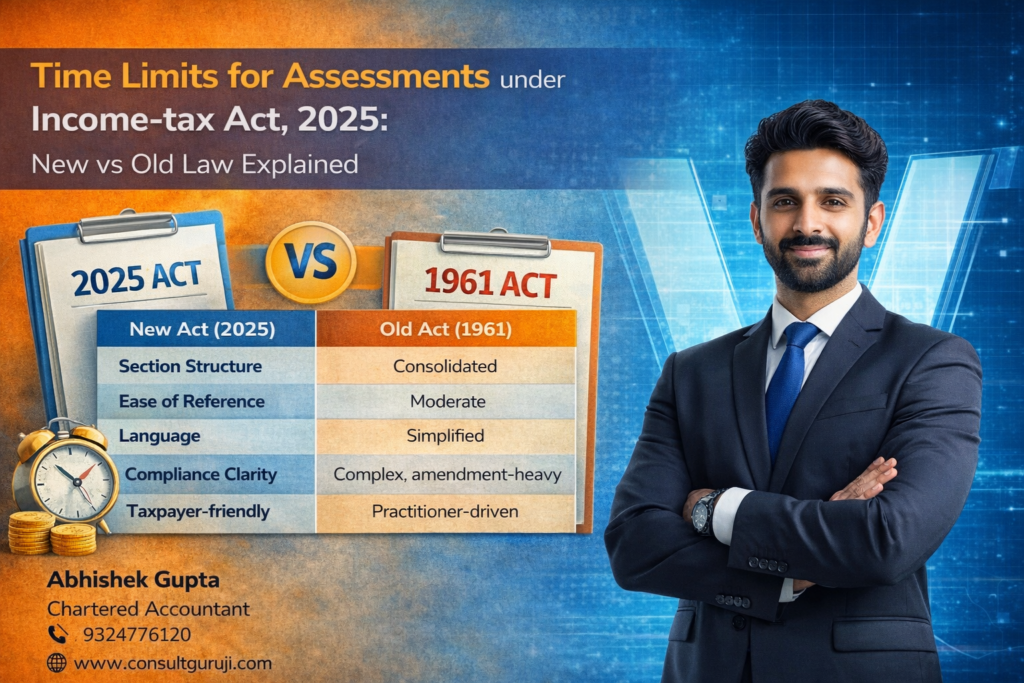

Tax Deducted at Source (TDS) is one of the most critical compliance mechanisms under India’s direct tax system. Under the Income-tax Act, 2025, TDS provisions have been restructured and renumbered to improve clarity, reduce confusion, and make compliance easier for taxpayers and professionals.

While the core concept of TDS remains unchanged, section numbers and logical grouping have been streamlined compared to the Income-tax Act, 1961. This article explains the new structure of TDS provisions and how they relate to the old law.

Why TDS Provisions Were Reorganised in 2025

The earlier Act had TDS sections scattered across multiple chapters with frequent amendments, making interpretation difficult. The 2025 Act aims to:

Create a logical flow of TDS provisions

Reduce dependency on explanations and provisos

Make section identification easier

Improve compliance and reduce litigation

What this really means is better usability without changing the tax burden.

Broad Structure of TDS under Income-tax Act, 2025

Under the new Act, TDS provisions are grouped systematically based on:

Nature of payment

Category of deductee

Special transactions (property, rent, virtual digital assets, etc.)

This makes it easier to identify the applicable section without jumping across the Act.

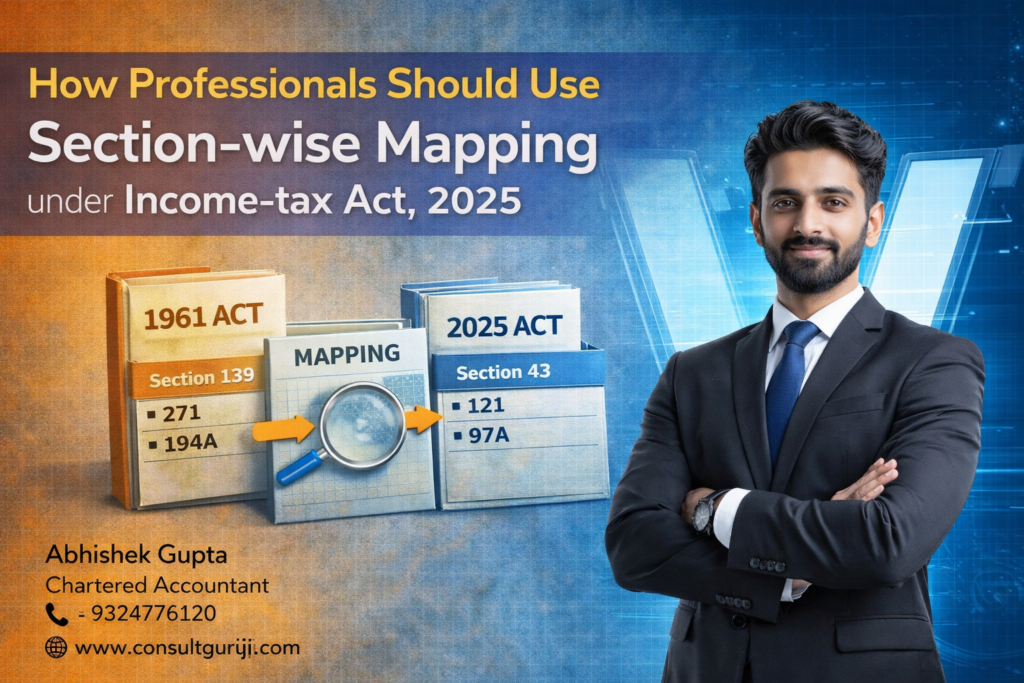

Section-wise Mapping: Old Act vs New Act (Indicative)

Nature of Payment Income-tax Act, 1961 Income-tax Act, 2025

Salary Section 192 Re-numbered under Salary TDS chapter

Interest (Other than securities) Section 194A New consolidated TDS section

Contract payments Section 194C Re-numbered business payment section

Professional / technical fees Section 194J Simplified and regrouped

Rent Sections 194I / 194IB Unified rent-related TDS provisions

Purchase of property Section 194IA Retained with new numbering

Virtual Digital Assets Section 194S Retained, renumbered

👉 Important: Only section numbers change. Rates, thresholds, and responsibility to deduct remain broadly the same unless specifically amended.

Key Improvements in TDS Framework (2025 Act)

Clear separation between regular TDS and special TDS cases

Reduced cross-references

Better alignment with compliance portals

Easier training for taxpayers and staff

Lower chances of wrong section application

Impact on Taxpayers and Deductors

For most taxpayers:

No fresh learning curve on rates

Better clarity while filing returns and paying TDS

Reduced errors in challans and returns

For professionals:

Faster advisory

Cleaner documentation

Better litigation handling due to structured sections

Practical Tip

While filing TDS returns or paying TDS under the new Act, always ensure:

Correct section mapping is used

Challan reflects the new section number

Supporting documentation mentions both old and new references during the transition period

Conclusion

The Income-tax Act, 2025 does not reinvent TDS but reorganises it intelligently. Once familiar with the new structure, taxpayers and professionals will find TDS compliance more intuitive and less error-prone.

Understanding section-wise mapping is the first step to smooth compliance under the new law.

Written by

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com