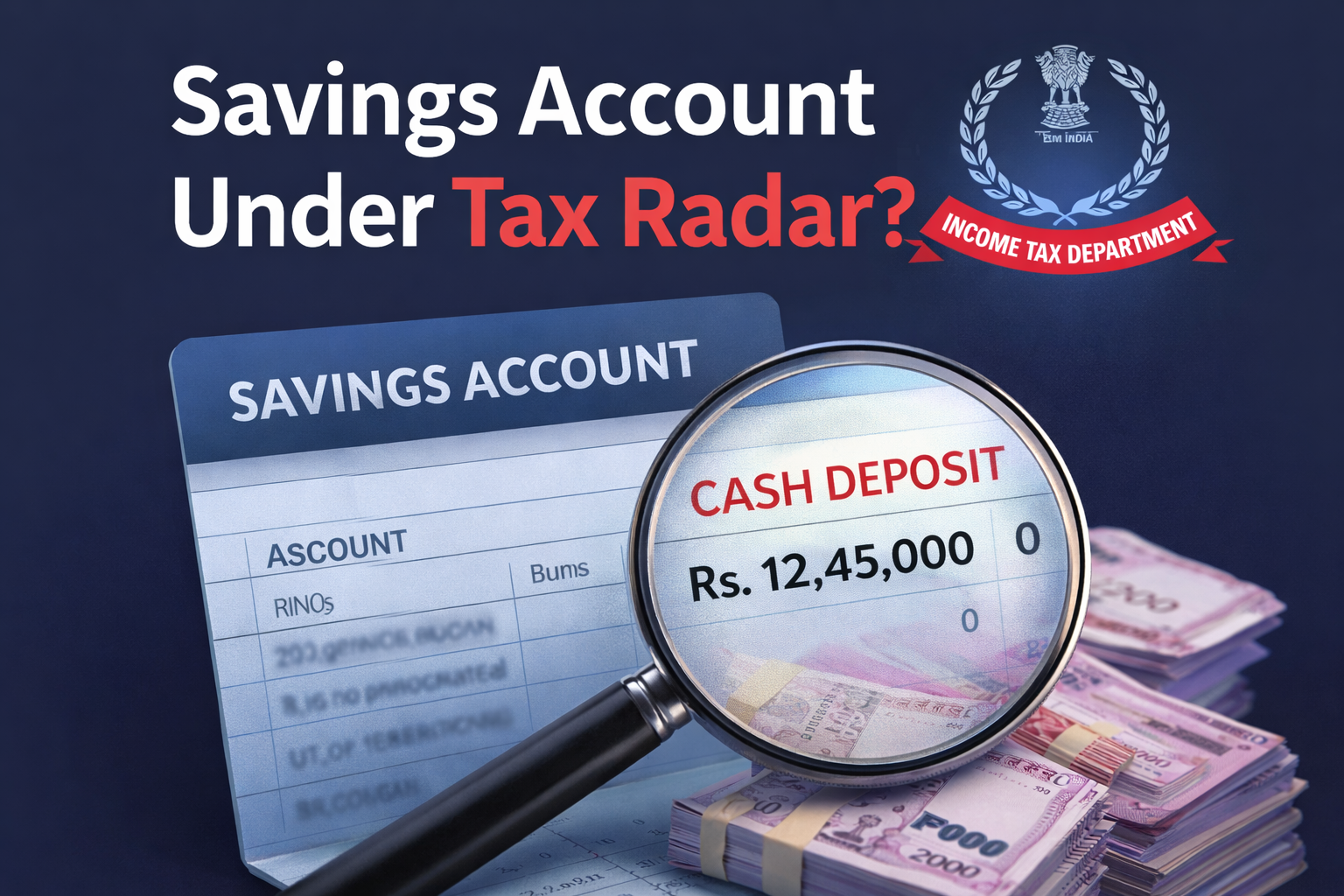

Savings Account Under Tax Radar?

❌ Savings Account Under Tax Radar?

Bahut log samajhte hain ki savings account personal hota hai,

aur usme jo cash deposit karein, woh private rehta hai.

Lekin reality thodi alag hai.

Agar aapka bank account PAN se linked hai,

to aapke transactions Income Tax Department ke system me visible ho sakte hain.

Chaliye simple language me samajhte hain 👇

🔍 Income Tax Ko Cash Deposit Kaise Pata Chalta Hai?

Banks high-value transactions report karte hain under:

👉 SFT (Statement of Financial Transactions)

Agar ek financial year me:

-

₹10 lakh ya usse zyada cash savings account me deposit hota hai

-

High-value fixed deposit hota hai

-

Large credit card payments hote hain

To bank automatically report karta hai.

Is process ko manually check nahi kiya jata —

system-based reporting hoti hai.

⚠️ Kya Sirf ₹10 Lakh Se Upar Risk Hai?

Nahi.

Limit sirf reporting ke liye hai.

Risk tab hota hai jab:

👉 Aapka declared income aur bank deposit mismatch karta hai.

Example:

-

ITR income = ₹4 lakh

-

Cash deposit = ₹14 lakh

System mismatch detect karta hai.

📩 Agar Mismatch Ho To Kya Ho Sakta Hai?

Aapko mil sakta hai:

✔ e-Campaign notice

✔ Section 133(6) information notice

✔ Section 142(1) notice

✔ Serious case me reassessment

Agar cash explain nahi ho paya to:

👉 Section 69A (Unexplained Money) lag sakta hai

👉 60%+ tax under Section 115BBE lag sakta hai

🛡️ Safe Kaise Rahein?

✔ Proper source documentation rakhein

✔ Business ho to cash book maintain karein

✔ ITR time par file karein

✔ AIS reconcile karein

✔ Large unexplained cash deposit avoid karein

Cash illegal nahi hai.

Unexplained cash risky hai.

📢 Conclusion

Savings account private zaroor hai,

lekin invisible nahi hai.

Income Tax Department data-driven system par kaam karta hai.

Agar numbers clean hain, tension ki baat nahi.

Agar mismatch hai, system knock karega.

Compliance sasta hai.

Litigation mehenga.

Written by:

Abhishek Gupta

Chartered Accountant

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com