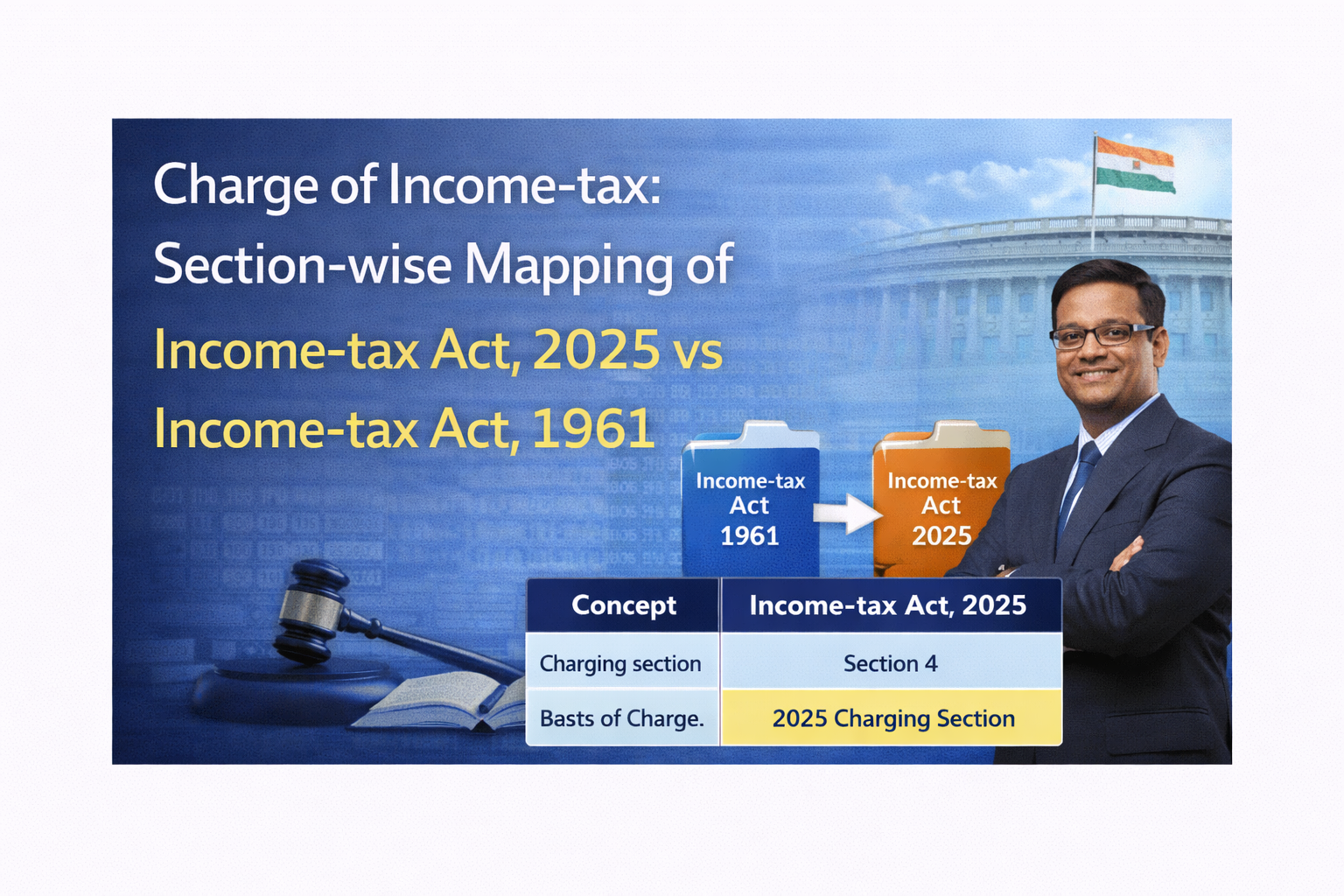

Charge of Income-tax: Section-wise Mapping of Income-tax Act, 2025 vs Income-tax Act, 1961

Introduction

The charge of income-tax is the foundation of India’s direct tax law. It determines when, how, and on whom income-tax is levied. Under the Income-tax Act, 1961, this concept was governed primarily by Section 4.

With the introduction of the Income-tax Act, 2025, the charge of income-tax has been retained in substance but reorganised for better clarity and structure. Understanding the section-wise mapping of charge provisions under the 2025 Act vis-à-vis the 1961 Act is essential for taxpayers and professionals.

Charge of Income-tax under Income-tax Act, 1961

Under the Income-tax Act, 1961:

Section 4 provided the charging provision

Income-tax was charged at rates prescribed by the Finance Act

Tax was levied on total income of the previous year

Scope depended on residential status and nature of income

Section 4 acted as the gateway provision for the entire Act.

Charge of Income-tax under Income-tax Act, 2025

The Income-tax Act, 2025 continues the same fundamental approach. The charging provision has been:

Retained with clearer drafting

Placed logically within the new structure

Aligned with simplified language

While the section number may be reorganised, the principle remains that income-tax is charged on total income at rates specified by law.

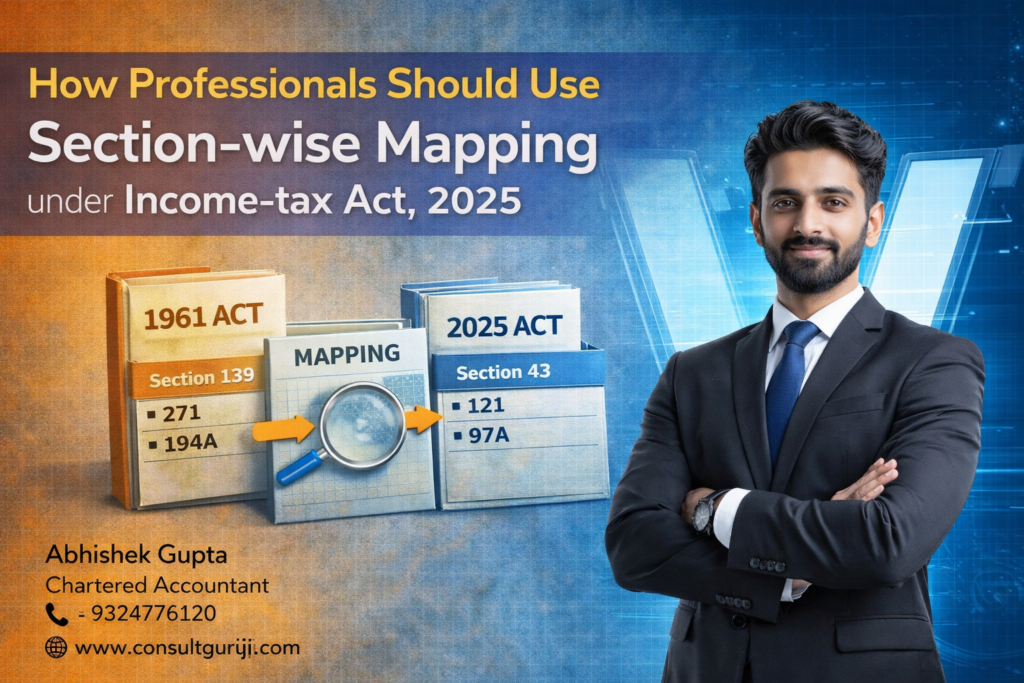

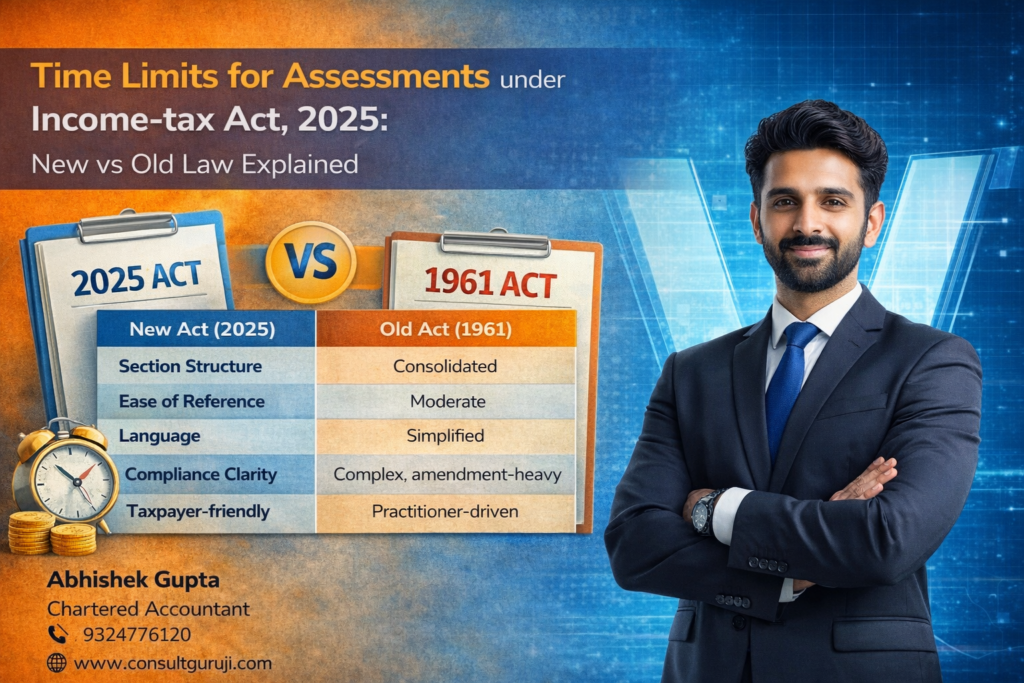

Section-wise Mapping: 2025 Act vs 1961 Act

Concept Income-tax Act, 1961 Income-tax Act, 2025

Charging provision Section 4 Corresponding charging section under 2025 Act

Basis of charge Total Income Total Income

Applicable rates Finance Act Finance Act

Link with residential status Yes Yes

The mapping ensures continuity so that judicial interpretations under the 1961 Act remain relevant.

What Has Changed in the New Act

The changes are structural, not substantive:

Improved language and drafting

Logical placement of provisions

Better linkage with related sections such as scope of income and residential status

There is no expansion of tax liability merely due to restructuring.

What Has Not Changed

Despite the new Act:

The concept of “total income” remains unchanged

Tax continues to be charged annually

Finance Act continues to prescribe rates

Judicial principles relating to charge remain applicable

This ensures legal continuity and certainty.

Practical Importance of Section-wise Mapping

Understanding this mapping helps in:

Interpreting assessment notices

Handling appeals and litigation

Applying old case laws to new sections

Ensuring correct compliance under the new Act

Professionals must correlate old section references with the new structure.

Conclusion

The charge of income-tax under the Income-tax Act, 2025 continues the core principles laid down under the Income-tax Act, 1961. The section-wise mapping ensures a smooth transition by preserving legal intent while improving clarity and organisation.

A clear understanding of this mapping is essential for accurate compliance and effective professional practice under the new tax regime.

Written by

Abhishek Gupta

Chartered Accountant

G Abhishek And Associates

Office No. 19, Sagar Building, 4th Floor, Plot-327,

Narshi Natha Street, Masjid Bunder (West),

Mumbai – 400009

📞 9324776120

🌐 www.consultguruji.com